Get ready to discover something interesting about Form 8853, the superhero of tax paperwork that deals with Archer Medical Savings Accounts (MSAs) and Long-Term Care (LTC) Insurance Contracts. Form 8853 is all about reporting your contributions and distributions from these accounts and contracts, giving you the lowdown on potential tax deductions and advantages.

Form 8853, often recognized as the “Archer MSA and Long-Term Care Insurance Contracts” form, might sound like tax jargon designed to baffle, but at its core, it’s a valuable instrument to wield in the realm of tax deductions and credits. Through this seemingly complex document, you can unpack a treasure trove of benefits related to healthcare expenses.

Its purpose extends beyond its technical designation, serving as a conduit to potentially reduce taxable income by accounting for eligible medical costs and insurance premiums. Beyond its name and apparent complexity lies a mechanism that empowers individuals to gain tax advantages.

Think of Form 8853 as a roadmap, guiding you through the labyrinth of healthcare-related expenses eligible for deductions and credits. Specifically, it homes in on contributions and distributions made through Archer MSAs and delves into the realm of Long-Term Care Insurance Contracts. By understanding and utilizing this form effectively, taxpayers can unlock avenues to alleviate the financial strain caused by healthcare expenditures, while simultaneously optimizing their tax situation. Form 8853, far from being an enigma, is a gateway to potentially substantial savings for those who explore its intricacies and make strategic use of its provisions.

By completing this form, you can not only ensure that you’re following the rules but also potentially reduce your taxable income or report any taxable payments from LTC insurance contracts correctly and lots more. So, grab a cup of coffee and prepare to dive into Form 8853 till you’ve uncover the secrets to saving money on your taxes!

As you read on, you will discover more enlightenment on;

- What Is Form 8853?

- How to File Form 8853

- What Can You Use Form 8853 For?

- When to Use Form 8853

Recap

1. What Is Form 8853?

Form 8853, often referred to as the “Archer MSA and Long-Term Care Insurance Contracts” form, and might initially strike as an enigmatic document. However, its technical label doesn’t need to overwhelm you. Essentially, it serves as a valuable instrument if you want to capitalize on specific health-related expenses for tax benefits.

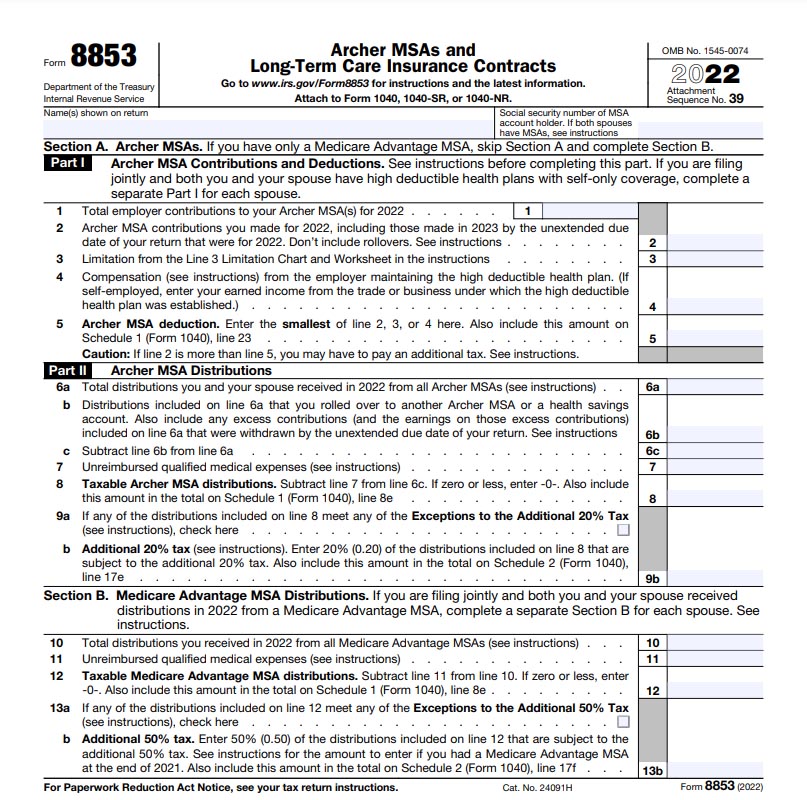

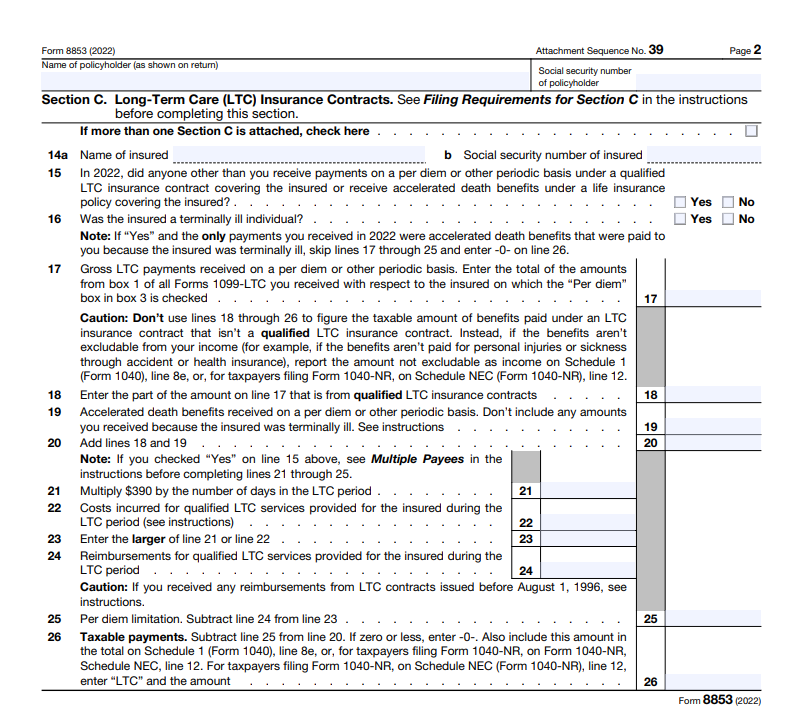

Form 8853 serves the purpose of reporting contributions and distributions linked to Archer Medical Savings Accounts (MSAs) and Long-Term Care (LTC) Insurance Contracts. This form is segmented into three distinct sections, each serving a specific purpose. Section A caters to Archer MSAs, Section B is dedicated to Medicare Advantage MSA Distributions, and Section C is reserved for reporting taxable payments stemming from LTC insurance contracts.

2. How to File Form 8853

Filing Form 8853 might seem like venturing into uncharted territory, but the process is more straightforward than you might think. Here’s a breakdown of how to file it:

i. Understanding Eligibility:

Initiating the filing process for Form 8853 involves several key steps. Understand your eligibility, this is the initial checkpoint. This form caters to individuals possessing Medical Savings Accounts (MSAs), Health Savings Accounts (HSAs), or Long-Term Care Insurance Contracts. If you fall into any of these categories, you’re on the right track to potentially harnessing the benefits offered by Form 8853.

ii. Gather Necessary Information:

After confirming eligibility, the subsequent step revolves around assembling comprehensive data concerning contributions, distributions, and qualified expenses linked to the respective accounts or insurance contracts. This involves collecting essential particulars encompassing personal information, account specifics, and expenditures associated with medical care or long-term care insurance payments made throughout the tax year.

Scrutinizing documentation, like receipts and records of healthcare expenses or education-related savings, becomes imperative to guarantee precise reporting on the form.

iii. Complete the Form:

This form typically comprises multiple sections, each designated for specific information. Adhere meticulously to the provided instructions, ensuring precise input of the required data into the respective segments.

iv. Attach to Your Tax Return:

Upon gathering all necessary details, the completed form can be included with your tax return, granting access to potential deductions or credits tailored to your situation. Once completed, don’t forget to attach Form 8853 to your annual tax return. This ensures that the IRS recognizes your eligible expenses and allows you to claim the appropriate deductions or credits. By following these guidelines diligently, you can effectively harness the benefits offered by the form and maximize your eligible tax advantages.

It is important to note that only taxpayers, who made contributions to Archer MSAs, received distributions from an Archer MSA, received Medicare Advantage MSA distributions or received taxable payments from LTC insurance contracts during the tax year are required to file Form 8853.

>>>PRO TIPS: Federal Tax Credit for Residential Solar Energy

3. What Can You Use Form 8853 For?

Wondering about the versatility of Form 8853? Brace yourself, as this form serves as a gateway to several financial perks. Firstly, it acts as a reporting hub for Archer MSA contributions, encapsulating both individual and employer contributions. Not just that, it aids in calculating your Archer MSA deduction, enabling a clearer understanding of potential deductions to optimize your tax situation. Beyond contributions, the form also serves as a means to report distributions from Archer MSAs or Medicare Advantage MSAs, facilitating comprehensive documentation of these financial transactions.

Furthermore, Form 8853 extends its coverage to the realm of long-term care (LTC) insurance contracts, serving as a platform to report taxable payments stemming from such agreements. But wait, there’s more! It doesn’t stop there—this form also provides a conduit to report taxable accelerated death benefits derived from a life insurance policy. Essentially, Form 8853 emerges as a versatile tool, encompassing various financial aspects such as contributions, deductions, distributions, and taxable payments, streamlining the reporting process for an array of tax-related endeavors.

4. When to Use Form 8853

There are multiple conditions that can necessitate the use of Form 8853, and it offers a roadmap for various financial situations within a tax year. Firstly, if contributions were made by you or your employer to an Archer MSA during the tax year, this form steps into play. Similarly, if you received distributions from either an Archer MSA or Medicare Advantage MSA or gained ownership or pay out from these accounts due to the original holder’s death, Form 8853 becomes essential for accurate reporting.

Moreover, the form is indispensable if you received taxable payments from a long-term care insurance contract or taxable accelerated death benefits from a life insurance policy. Beyond these specific events, utilizing Form 8853 becomes advantageous when you’ve incurred substantial medical expenses or made payments toward long-term care insurance, allowing you to leverage potential tax benefits. Additionally, those seeking to capitalize on tax advantages associated with Health Savings Accounts (HSAs) or Medical Savings Accounts (MSAs) will find this form as a key instrument in navigating and maximizing these benefits.

>>>GET SMARTER: Form 8917: What It Is, How to File It

Recap

Form 8853 stands as a pivotal tool that helps you to navigate the complexities of tax deductions and credits, particularly concerning health-related expenses. Whether you want to report contributions and distributions from Archer MSAs, delve into Medicare Advantage MSA Distributions, or account for taxable payments from LTC insurance contracts, this form offers a structured approach to accurately document crucial financial transactions.

Understanding and utilizing Form 8853 not only ensures compliance with tax regulations but also presents opportunities for individuals to optimize their tax situations by leveraging eligible benefits. Embracing this form equips taxpayers with the means to navigate the intricacies of healthcare-related financial transactions, maximizing potential deductions, and credits while providing a clear avenue for reporting crucial financial information.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.