Are you navigating the maze of adoption-related tax credits and wondering how to optimize your financial benefits? Form 8839 is not just a document; it’s a gateway to unlocking crucial adoption-related tax credits that can significantly impact your financial landscape. In this journey, Form 8839 becomes your map, guiding you to claim the adoption tax credit you deserve. If you want to secure your financial well-being and ensure you’re making the most of available tax advantages, understanding how to file Form 8839 is pivotal. Whether you’re a seasoned taxpayer or a newcomer to the world of tax credits, this guide will equip you with the knowledge to navigate Form 8839 successfully. This isn’t just about compliance; it’s about maximizing the financial support available to you. So, are you ready to delve into the world of Form 8839 and unlock the potential to enhance your financial stability while growing your family?

To delve into the world of Form 8839:

- Determine Your Eligibility

- Gather the Required Documents

- Download Form 8839

- Complete the Form

- Attach Supporting Documents

- Check for Accuracy

- Calculate Your Adoption Credit

- Complete Additional Forms

- File Your Tax Return

- Keep Copies for Your Records

- Recap

1. Determine Your Eligibility

To understand the nuances of claiming adoption-related tax credits, explore the eligibility criteria set by the IRS. For instance, the IRS outlines that eligible adoption expenses include adoption fees, court costs, attorney fees, and travel expenses. By delving into these details, you can ensure you are well-informed about what qualifies for the credit. Additionally, it’s crucial to understand any income limitations that might affect your eligibility for the credit.

The IRS adjusts these limits annually, so staying updated on the current thresholds ensures that you can make informed decisions about your adoption-related expenses. Moreover, exploring specific requirements related to the adopted child’s age or special needs can provide further insights into the eligibility criteria. By thoroughly grasping these details, you not only maximize your chances of claiming the adoption tax credit but also ensure compliance with IRS regulations, contributing to a smooth and financially advantageous adoption process.

>>>MORE: Form W-7: What It Is, How to File It

2. Gather the Required Documents

To ensure you make the most of adoption benefits on your tax return, gather all necessary documents. Collect receipts for adoption-related expenses, such as transportation, meals, and lodging, during the adoption process. These documents substantiate your claims and help maximize your eligible credit.

For instance, if you incurred travel expenses to bring the adopted child into your home, maintaining detailed records of airfare, hotel stays, and meals provides concrete evidence of qualifying expenditures. The IRS allows for the inclusion of these documented expenses, ensuring that you capitalize on the full extent of the adoption tax credit. By meticulously assembling all pertinent documents, you not only facilitate a smooth filing process but also guarantee that you receive the maximum financial benefit available for your adoption efforts.

3. Download Form 8839

To navigate the complexities of Form 8839 filing efficiently, download the form directly from the official IRS website or use reputable tax preparation software. This ensures you have the latest version of the form, incorporating any updates or changes in regulations.

>>>PRO TIPS: Form 8332: What It Is, How to File It

4. Complete the Form

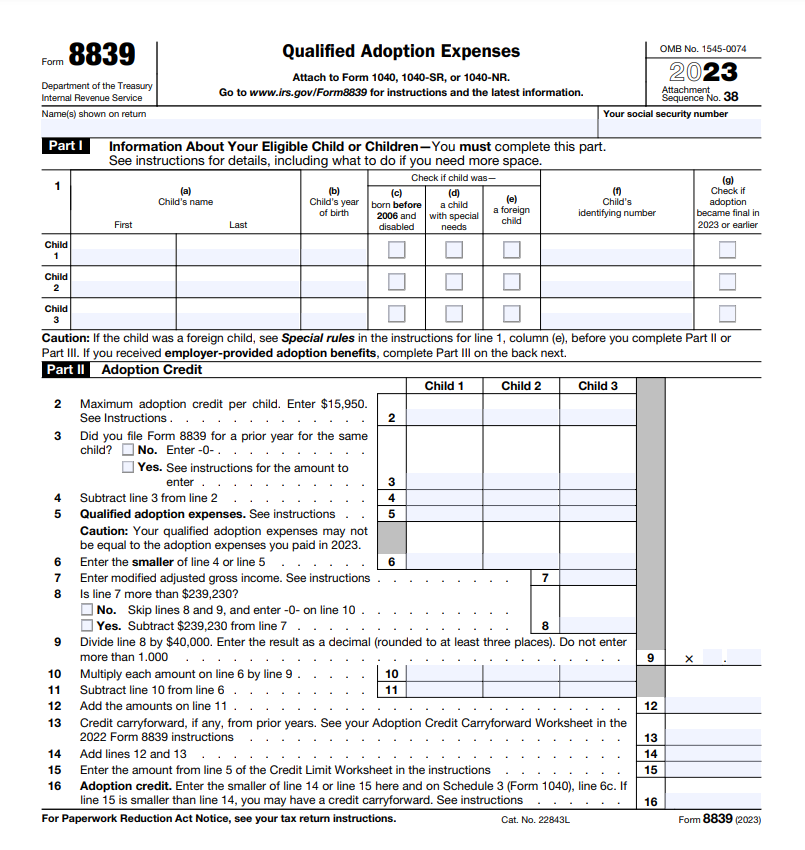

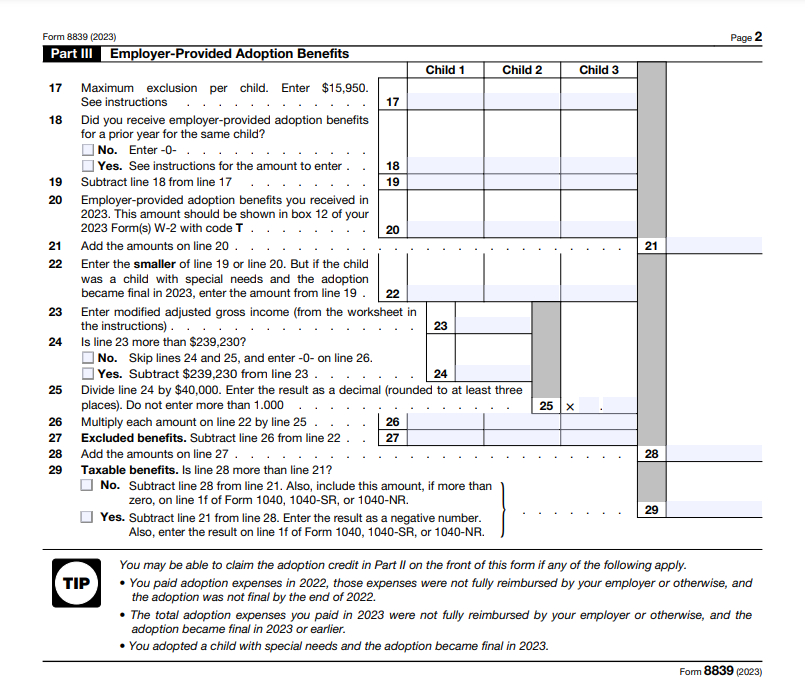

To safeguard your financial interests and optimize adoption-related tax advantages, complete Form 8839 accurately. This involves providing detailed information about the adopted child, the adoption expenses, and any employer assistance received. Thorough completion ensures you claim the maximum credit available.

Remember to include the adopted child’s legal name, date of birth, and taxpayer identification number. Outline all eligible adoption expenses, such as court and attorney fees, travel expenses, and adoption agency fees. Additionally, accurately report any financial assistance provided by your employer, as this may impact the total credit amount. By diligently filling out these details, you not only ensure compliance with IRS regulations but also guarantee that you receive the full financial benefits associated with the adoption tax credit.

5. Attach Supporting Documents

To make the process of filing Form 8839 seamless, attach all supporting documents. For example, include adoption agency statements, legal documents confirming the adoption, and receipts for qualifying expenses. This comprehensive documentation substantiates your claims and facilitates a smooth filing process. The IRS requires detailed proof of the adoption process, and attaching these documents ensures that your application is complete and accurate.

Adoption agency statements offer official confirmation of the adoption proceedings; legal documents provide evidence of the legal transfer of parental rights; and receipts validate qualifying expenses, such as adoption fees and court costs. By including these supporting documents, you not only meet the IRS requirements but also establish a robust foundation for your adoption-related tax credits, minimizing the likelihood of delays or issues during the processing of your Form 8839.

>>>GET SMARTER: Form 8917: What It Is, How to File It

6. Check for Accuracy

To protect your financial well-being and ensure accurate reporting of adoption-related expenses, cross-check your completed form and supporting documents for accuracy. For instance, verify that all expenses claimed meet the IRS criteria for eligibility. This attention to detail reduces the risk of errors that could delay processing. Common errors include miscalculating eligible expenses or missing out on certain credits. By being aware of these pitfalls, you can navigate the filing process more effectively.

7. Calculate Your Adoption Credit

To avoid common pitfalls and errors in Form 8839 filing, identify eligible adoption expenses, such as adoption fees and legal costs. Ensure meticulous documentation of each expense, and be mindful of income limits and the maximum allowable credit for the tax year.

Apply the relevant percentage to your qualifying expenses and consider any employer assistance received. Complete Form 8839 with accurate information, attaching supporting documents like adoption agency statements and receipts. Stay updated on tax law changes, and file your tax return, either electronically or by mail, before the deadline. By following these steps, you can accurately calculate your adoption credit, maximize the benefit for eligible expenses, and ensure a smooth filing process.

8. Complete Additional Forms

To stay in compliance with tax regulations while filing Form 8839, explore any additional forms that might be required. Depending on your circumstances, you may need to fill out other forms related to your tax return, such as the standard 1040 form or additional schedules. Ensure you are aware of all necessary documentation.

9. File Your Tax Return

To protect your financial stability and optimize adoption-related tax benefits, get started with the filing of your tax return well before the deadline. This proactive approach ensures you have ample time to address any issues that might arise during the filing process and helps you avoid last-minute stress.

10. Keep Copies for Your Records

To maintain comprehensive records for Form 8839, the Adoption Credit, meticulous organization is essential. Keep copies of filed tax returns, especially Form 8839, for future reference. Correspondence with adoption agencies and professionals, along with records of any special needs of the adopted child, should be maintained. Develop a timeline of expenses for clarity. Regularly review and update your records to ensure accuracy and readiness for potential IRS inquiries, enabling a smooth and successful tax filing process for adoption-related expenses.

Recap

In conclusion, filing Form 8839 is a strategic financial move that can significantly benefit you and your family. By understanding the eligibility criteria, gathering essential documents, and navigating the intricacies of the form diligently, you empower yourself to maximize adoption-related tax credits.

Remember to calculate your credit accurately, stay informed about IRS guidelines, and proactively file your tax return to secure your financial well-being. Guard against common pitfalls by cross-checking your information and, when needed, seeking professional advice. Filing this form is not just about compliance; it’s about optimizing the financial support available for the noble cause of adoption. So, embark on this process with confidence, knowing that you are taking essential steps to build a brighter and more secure financial future for your family.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.