Form 8820, the Orphan Drug Credit form, is a critical document for eligible entities in the United States. It is designed to provide incentives for pharmaceutical companies and certain research organizations involved in the development of orphan drugs, which treat rare diseases affecting fewer than 200,000 people.

To qualify for this credit, you must meet specific criteria, including FDA orphan drug designation and appropriate clinical testing. Filing Form 8820 can result in a valuable tax credit that significantly offsets the costs associated with orphan drug research.

Therefore, ensure your eligibility, gather accurate information, and follow the IRS guidelines diligently. This form plays a pivotal role in supporting breakthroughs for rare diseases, so it’s essential you navigate it correctly.

Form 8820, Orphan Drug Credit: What It Is, Who Qualifies, How to File:

- Understanding Form 8820

- Qualifying Entities

- Rare Disease Criteria

- Clinical Testing Requirement

- Calculating Tax Credit

- Filing Process

- Deadline and Extensions

- Orphan Drug Credit Carryforwards

Recap

1. Understanding Form 8820

It is important you understand the significance of Form 8820, the Orphan Drug Credit, because it plays a crucial role in incentivizing the development of medications for rare diseases. This form grants you a tax credit for expenses incurred in the research and development of orphan drugs, specifically those designed to treat rare conditions.

To qualify, your drug must receive orphan drug designation from the FDA, indicating its potential to help patients with limited treatment options. This is a substantial benefit, as it can offset up to 50% of your qualified clinical testing expenses. Make sure you accurately document these expenses so you can benefit from this essential tax credit.

2. Qualifying Entities

Take note of the following qualifying entities for Form 8820, as it is crucial for benefiting from the Orphan Drug Credit:

- Drug Manufacturers: If you produce orphan drugs for rare diseases, you qualify for this credit. These are drugs that treat conditions affecting fewer than 200,000 individuals in the United States.

- Orphan Drug Designees: You are eligible for Form 8820 tax credit if you’ve obtained the orphan drug designation from the U.S. Food and Drug Administration (FDA). This status is granted to drugs for rare diseases, and it signifies that your drug qualifies for special incentives, including the Orphan Drug Credit.

- Qualified Clinical Testing Sponsors: You are a qualifying entity if you sponsor funding for clinical testing of orphan drugs. You play a significant role in advancing these treatments.

- Tax-Exempt Organizations: Certain tax-exempt organizations such as a medical research foundation can benefit from this credit when it conducts qualified clinical testing on behalf of drug manufacturers.

Make sure you or your entity fits into one of these categories and thoroughly verify your eligibility to ensure a successful application.

3. Rare Disease Criteria

Here’s what you need to know about the rare disease criteria for Form 8820, the Orphan Drug Credit:

- Patient Population: You must confirm that the disease for which the drug is intended affects fewer than 200,000 individuals in the United States. This is a critical criterion, and it’s vital you ensure that your drug’s target disease meets this threshold.

- Clinical Testing: Your drug must be in the process of clinical testing or already approved by the FDA. You have to be actively engaged in advancing the development or accessibility of the drug for the rare disease.

- Research Data: Keep in mind that accurate, up-to-date data on the prevalence of the disease is crucial. This data helps establish eligibility and supports your application.

>>>PRO TIPS: Form 8332: What It Is, How to File It

4. Clinical Testing Requirement

The clinical testing is the backbone of the Orphan Drug Credit, Form 8820, and it’s your responsibility to ensure its proper execution.

As a drug developer, you must conduct clinical trials that demonstrate the drug’s effectiveness and safety in treating rare diseases, which is the essence of this tax credit. It’s not just any testing; it has to be for the designated rare disease.

The clinical testing must be valid, ongoing, and meticulously documented. So, what you need to do is maintain thorough records of the testing processes, patient data, and any adverse reactions. Stay compliant with FDA regulations and be ready to provide evidence when filing Form 8820.

5. Calculating Tax Credit

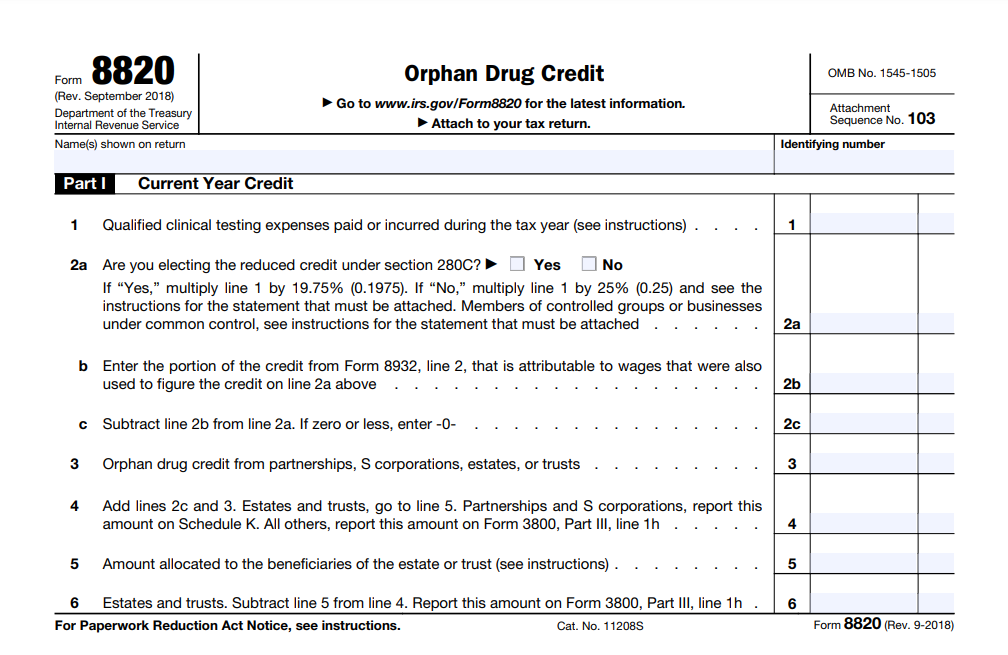

Calculating the Orphan Drug Credit of Form 8820 is a precise process that you must follow carefully. First, ensure you have accurate data of your qualified clinical testing costs, including research, development, and testing expenses. You’re responsible for this step.

Next, consider the tax year. You can claim the credit for qualified clinical testing expenses incurred during the tax year. It’s vital you keep track of these expenses as it occurs.

Now, calculate the credit itself. The primary credit for your qualified clinical testing expenses is 50%. It means that you can claim a credit equal to 50% of the expenses you incur during the tax year for the clinical testing of an orphan drug. For example, if you spend $100,000 on qualified clinical testing, your credit would be $50,000.

In some cases, you may also qualify for 25% credit on specific clinical testing expenses, such as clinical testing you conduct outside the United States or expenses related to the cost of materials. This credit provides extra financial incentives for specific types of expenses related to the orphan drug development process.

It’s essential you note that the credit cannot exceed 50% of the total qualified clinical testing expenses. So, if your total testing expenses is $120,000, the credit would still be limited to $60,000 (50% of $120,000) even if you qualify for the 25% credit for certain expenses.

In other words, you can’t combine the two credits to exceed 50% of your total expenses. To clarify, the 25% credit doesn’t add to the 50% credit but provides an extra benefit for particular expenses within the overall limit.

Finally, when you complete your Form 8820, make sure you provide all necessary details and documentation to support your calculations.

>>>GET SMARTER: Form 8917: What It Is, How to File It

6. Filing Process

To file Form 8820 and claim the Orphan Drug Credit, follow these steps:

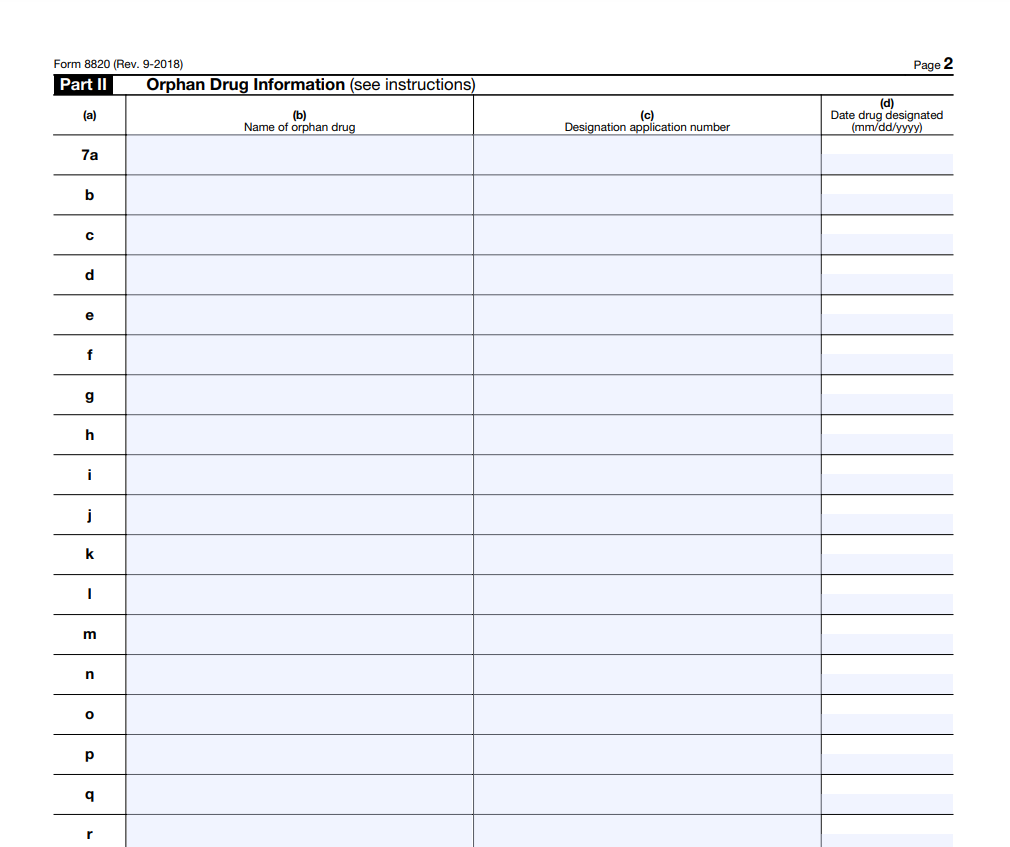

- Gather Documents: Collect all necessary records, including Orphan Drug Designation and clinical testing expenses.

- Complete Form 8820: Fill out every section of the form accurately.

- Attach Documentation: Include all required proof and supporting materials.

- Double-Check Details: Ensure accuracy and completeness before submission.

- File with the IRS: Send the form and attachments to the IRS.

- Track Submission: Keep copies of the filled Form 8820 and any delivery confirmation receipts for your own records.

- Await Response: The IRS will review and process your submission.

- Receive Confirmation: You’ll get notice of your Orphan Drug Credit approval or any additional requirements.

- Consult a Professional: If needed, seek tax advice or assistance to navigate this process.

7. Deadline and Extensions

Take note of the deadline and any extension for filing Form 8820. You must submit the form by the due date of your income tax return. If you don’t file it on time, you risk losing the Orphan Drug Credit.

However, if you need more time, request an extension for filing your income tax return. This extension also applies to Form 8820. An extension gives you extra six months to submit the form.

To request an extension, use IRS Form 7004. You must submit this extension application before your original due date. Make sure it’s accurate and complete, as incomplete or late requests may be denied.

But here’s a crucial point: an extension grants you extra time for filing but not for paying any tax you owe. Ensure you estimate and pay any tax liability to avoid penalties and interest.

8. Orphan Drug Credit Carryforwards

Form 8820 Orphan Drug Credit carryforwards means if you have unused orphan drug credits in a tax year, you can carry them forward to offset your future tax liabilities. Here’s what you need to do:

First, keep track of your orphan drug credits diligently. When you find that you’ve generated more credits than you can use in the current year, don’t worry. These unused credits won’t expire. Instead, it becomes a valuable resource to reduce your tax burden in the coming years.

So, what’s vital is that you plan strategically. You can carry these credits forward for up to 20 years, but you must remember that it can only be used to offset the Orphan Drug Credit portion of your tax liability in those future years.

In essence, this provision offers you flexibility, allowing you to make the most of your credits and reap its benefits over an extended period.

Recap

Form 8820, the Orphan Drug Credit, rewards you for developing drugs for rare diseases. To qualify, ensure you have FDA designation, maintain clinical testing records, and calculate your credit accurately. Submit the form before the deadline and consult professionals for a reliable process.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.