Tired of wading through a sea of complex tax forms with no clear direction? Enter Form 8332—the key to simplifying your tax filing journey. In the realm of tax documents, it’s easy to feel overwhelmed, but Form 8332 stands out as a beacon of clarity and potential benefits.

Form 8332 isn’t just another piece of paperwork; it’s a strategic tool designed to help you claim specific tax benefits related to your dependent children. Imagine being handed a golden ticket that unlocks credits and deductions you may not have realized were within your reach. This form plays a crucial role by allowing the custodial parent to relinquish claim to certain child-related tax benefits, empowering the noncustodial parent to step in and claim those benefits for a particular tax year.

The process of filing Form 8332 is refreshingly straightforward. It involves clear communication between custodial and noncustodial parents, acting as a bridge of understanding. This form ensures that the right individual receives the tax perks eligible parents are entitled to, fostering cooperation between co-parents.

Think of Form 8332 as your tax compass, guiding you through the intricate landscape of tax filings with ease. It’s more than just a form; it’s a practical solution to simplify your tax life. When you divorce and you want to claim your child as dependent, remember that Form 8332 is your shortcut to a stress-free and rewarding journey. Ready to make your tax filing experience smoother? Form 8332 is the answer you’ve been searching for.

Follow these steps to know what is Form 8332 and how to file it:

- Purpose and Significance of Form 8332

- Who Needs to File Form 8332

- How to File Form 8332

- Deadline and Submission

- Electronic Filing Options

- Potential Issues and Considerations

Recap

1. Purpose and Significance of Form 8332

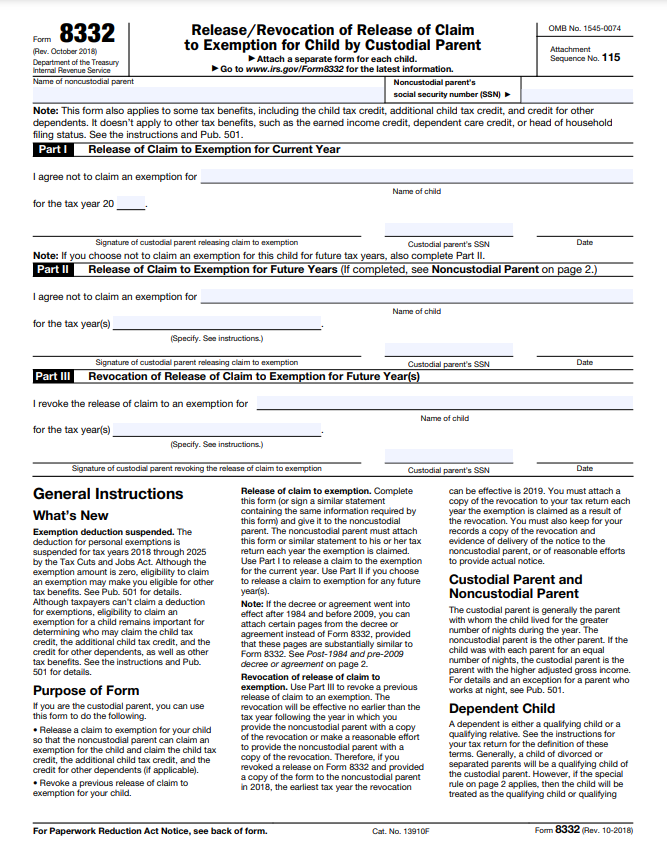

Form 8332, or the “Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent,” is a document for parents navigating separation or divorce while sharing custody of their child. This form plays a pivotal role in clarifying whether the parent is eligible to claim the child as a dependent for tax purposes. When facing this situation, comprehend the significance of Form 8332, as it directly influences your tax-related rights.

In essence, this form outlines the custodial parent’s decision to release or revoke their claim to exemption for the child, impacting the other parent’s ability to make such a claim. The Internal Revenue Service (IRS) relies on Form 8332 to ascertain and regulate the rightful claimant for tax benefits associated with dependent children.

Therefore, if you find yourself in a co-parenting scenario post-separation, understanding and correctly filing Form 8332 becomes paramount to ensuring accurate and lawful tax filings. It not only defines your financial responsibilities but also safeguards your parental rights in the context of tax claims for your child.

2. Who Needs to File Form 8332

Form 8332 is a crucial document for people navigating divorce, separation, or similar circumstances. If you find yourself in the position of a custodial parent seeking to relinquish the claim to your child’s exemption and other associated tax benefits to the noncustodial parent, then you are the one who needs to file Form 8332.

In such situations, this form serves as a formal agreement, facilitating the transfer of specific tax advantages from one parent to another. By completing Form 8332, you are essentially providing consent for the noncustodial parent to claim the child’s exemption and other related tax benefits for the specified tax year.

It’s important to recognize that filing this form is not a casual matter; it has legal implications and should be approached with care. Ensuring the accurate completion and submission of Form 8332 is essential for both parents to avoid potential conflicts and adhere to tax regulations. Remember, this process is designed to streamline the allocation of tax benefits in situations where parents share custody responsibilities but may have distinct financial responsibilities.

>>>PRO TIPS: What Is Form 8960: Net Investment Income Tax

3. How to File Form 8332

To successfully file Form 8332, start by entering your personal details, including your name, address, and Social Security number. Proceed to input the relevant information for the noncustodial parent, which includes names, addresses, and Social Security Number, ensuring accuracy for the specified tax year. Make sure both parents sign the form and securely attach it to the noncustodial parent’s tax return.

Take the following steps:

- Personal Information: Begin by supplying your own details: name, address, and Social Security Number.

- Child’s Details: Fill in the required information about the child, including their name, Social Security Number, and birthdate.

- Tax Year: Clearly indicate the tax year for which you are submitting Form 8332.

- Claim Status: Specify whether you are releasing or revoking your claim to the child’s exemption.

- Supporting Documentation: Along with Form 8332, you may need to include additional documentation to support your claim. This can include a written agreement between the parents, a divorce decree, or a court order.

- Signature and Date: Conclude the process by signing and dating the form, confirming the accuracy of the provided information.

Remember, precision is crucial throughout this process, and both parents must actively participate in completing and signing the form.

4. Deadline and Submission

Meeting the annual deadline for Form 8332 submission is crucial. You must file this form annually, ensuring it accompanies the noncustodial parent’s tax return, due by the standard tax deadline, usually April 15th. Your prompt submission of the form is paramount, as it directly influences the smooth processing of your tax return. Delays or complications may arise if the deadline is not met, potentially impacting your financial matters.

To guarantee a seamless process, mark your calendar well in advance of the April 15th deadline each year. Take steps to gather the necessary information for Form 8332 and submit it along with the noncustodial parent’s tax return promptly. By adhering to this deadline, you not only fulfill a mandatory requirement but also contribute to the efficiency of the overall tax filing process. Remember, timely action ensures that your tax return moves through the system without unnecessary hindrances, safeguarding your financial interests.

Don’t forget to file Form 8332 accurately and on time to avoid potential disputes or penalties. Keep a copy of the form for your records, along with any supporting documentation, to provide proof in case of an audit or review by the IRS.

5. Electronic Filing Options

Embracing electronic filing is crucial to your tax journey. The Internal Revenue Service (IRS) strongly advocates for this method, emphasizing the convenience it offers. When dealing with Form 8332, rest assured that electronic submission is a viable option. To proceed, choose reliable tax software compatible with electronic filing.

Navigating electronic filing may seem daunting, but with the right tools, it becomes a streamlined process. Opting for this modern approach ensures efficiency and reduces the likelihood of errors. As you embark on this journey, remember that the IRS actively supports and promotes electronic filing, recognizing its benefits for both taxpayers and the overall system.

To make the most of electronic filing, stay informed about updates to tax regulations and leverage user-friendly software. Trust in the electronic filing options endorsed by the IRS and confidently embrace a smoother tax experience.

>>>GET SMARTER: Form 8917: What It Is, How to File It

6. Potential Issues and Considerations

In navigating Form 8332, addressing potential issues and considerations becomes crucial. If your intention is to alternate claiming the child’s exemption, establish a clear agreement with the custodial parent. This ensures a smooth process and minimizes the risk of conflicts. Remember, communication is key in these matters.

Furthermore, maintain meticulous records by keeping copies of all filed forms. This practice serves as a precautionary measure, as these documents might be necessary in the event of an audit. By managing your paperwork, you not only adhere to regulatory requirements but also safeguard your interests.

Understand that the details matter. Pay close attention to the specifics of any agreement and ensure that it aligns with legal requirements. Being thorough now can prevent complications later. So, as you navigate Form 8332, approach it with a meticulous mindset, emphasizing clarity and documentation to mitigate potential issues down the road.

Recap

In conclusion, Form 8332 proves to be a pivotal tool for separated or divorced parents navigating the intricate landscape of tax forms. Its significance lies in facilitating the equitable distribution of tax benefits between custodial and noncustodial parents. To streamline the tax-filing process, furnish precise information and adhere to timely submissions.

The complexity of tax matters necessitates a proactive approach, staying informed about potential considerations that may arise during the filing. Consult with a tax professional to ensure accuracy and compliance with the latest IRS guidelines.

Maintain meticulous records of custody arrangements and ensure it align with the form’s requirements. Prioritize timely submission to avoid complications and delays. Also, be vigilant about any changes in tax laws that might impact the form’s specifications. Additionally, communicate openly with the other parent to preemptively address any discrepancies. Furthermore, leverage online resources and IRS publications for comprehensive guidance. Consider seeking professional advice to navigate nuanced situations.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.