Ever heard of Form 3520? It’s not just another piece of paper; it’s a key document that could significantly impact your financial world. So, what exactly is it, and why should you care? Well, buckle up, because you’re in for an eye-opener.

Form 3520 is essentially the IRS’s way of keeping tabs on your foreign financial transactions. Picture it as a financial report card that the government wants you to fill out if you’ve got financial ties beyond U.S. borders. It’s not about snooping; it’s about transparency.

Now, you might wonder, Why bother with this form? Ignoring it isn’t an option. If you have substantial transactions with foreign trusts or receive hefty gifts or inheritances from overseas, this form is your go-to. It’s like a financial handshake between you and the IRS, ensuring everyone’s on the same page.

Filing it? Don’t worry; it’s not as complex as it might seem. You detail your foreign financial dealings, gifts, or inheritances, and presto—you’re good to go. But here’s the kicker—missing out on this could lead to penalties. And believe it, you don’t want to go down that road.

So, imagine this form as your passport to hassle-free international financial dealings. By staying on top of Form 3520, you’re not just following the rules; you’re ensuring your financial journey is smooth sailing. Interesting right? Stick around and unravel more about how to navigate the ins and outs of Form 3520, making sure you’re in the driver’s seat of your financial destiny.

Follow these steps to understand what is Form 3520 and how to file it:

- Understand What is Form 3520

- Who Need to File 3520

- Reporting Requirements

- Check Threshold

- Calculate Report and Taxes

- Filling Process and Deadlines

- Penalties for Non-Compliance

Recap

1. Understand What is Form 3520

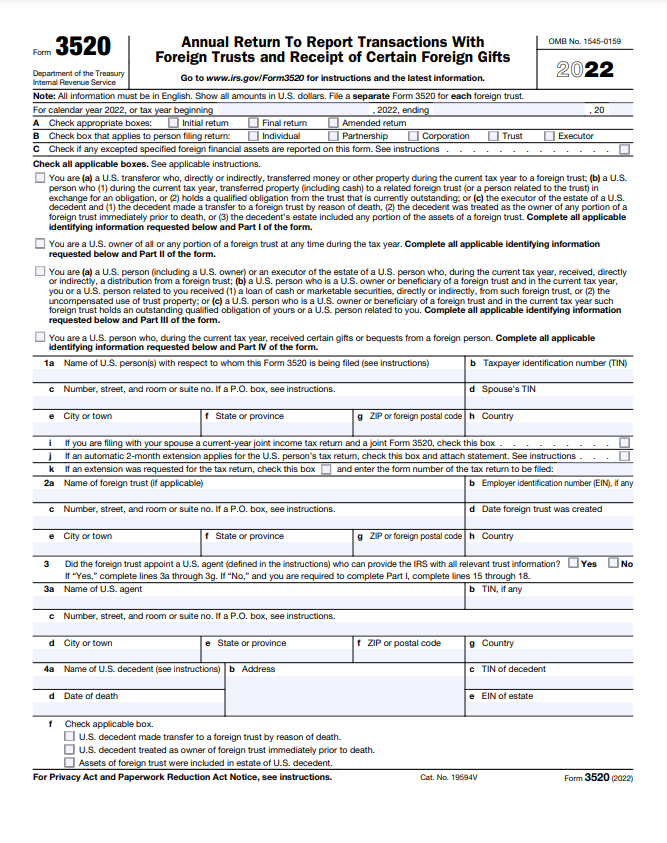

Form 3520 serves as your ticket to transparency with the IRS regarding substantial foreign financial dealings. If you’ve received a gift exceeding a certain value from a foreign person or entity or have been involved with foreign trusts, this form is your way of keeping the government in the loop.

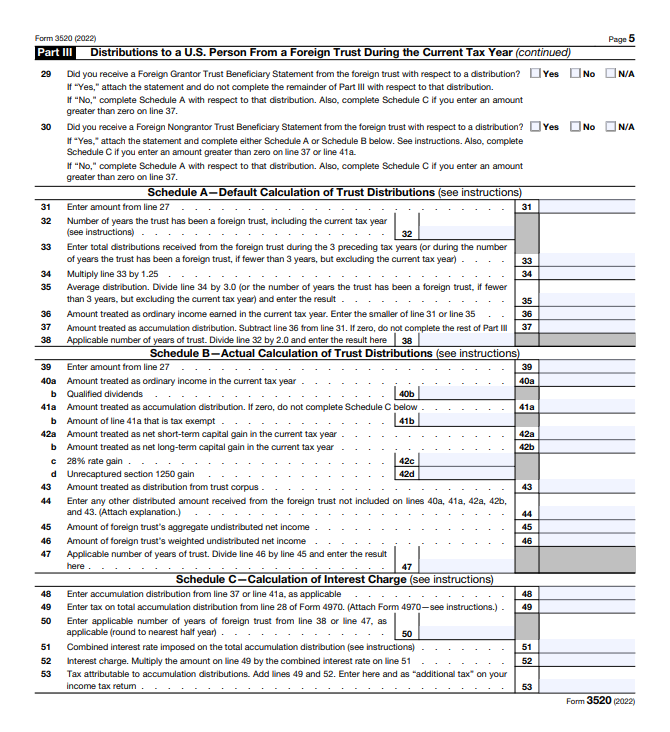

When completing Form 3520, you step into the realm of financial disclosure, a crucial aspect of maintaining transparency with the IRS concerning your international financial engagements. This form acts as your conduit to communicate substantial transactions involving foreign trusts, estates, and gifts. It is your personalized record of financial interactions beyond borders, making the IRS aware of your ties to foreign entities and assets.

Each entry on Form 3520 carries weight, as it signifies your commitment to complying with tax regulations. The IRS requires accurate reporting of transactions, emphasizing the importance of providing a detailed account of foreign gifts and financial involvements. Neglecting this duty may expose you to penalties, underscoring the significance of meticulous attention to detail.

2. Who Needs to File 3420

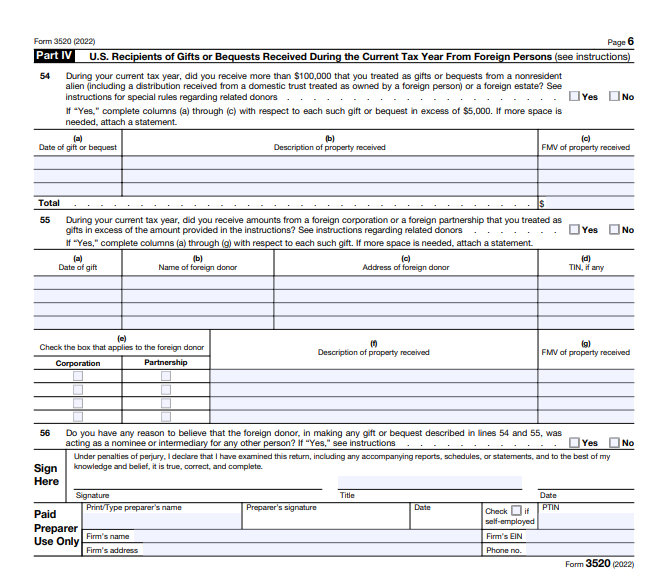

If you get a significant gift or inheritance from another country that’s worth a good amount, you need to fill out Form 3520.

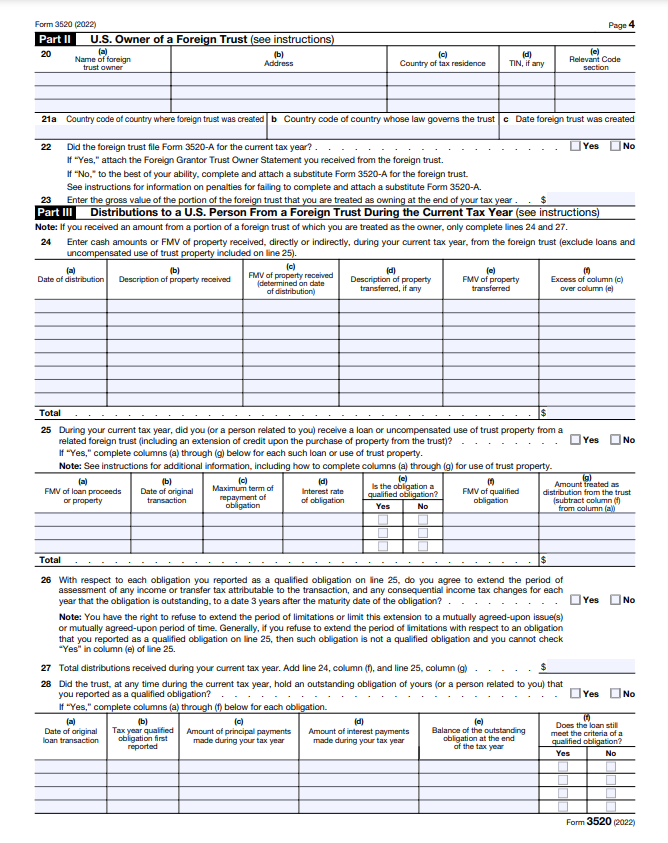

If you’re considered the owner of some part of a foreign trust, you also need to fill out that same form. It’s a way of keeping track of money-related stuff happening outside your home country.

So, imagine it as a kind of paperwork you do to keep everything up-to-up with the tax people. It’s not an option; it’s a must-do when certain international money things happen. It might sound a bit complex, but it’s just the system’s way of making sure you play fair with your finances, no matter where it come from. If you ever find yourself in these situations, remember that Form 3520 is your go-to form.

>>>PRO TIPS: Federal Tax Credit for Residential Solar Energy

3. Reporting Requirements

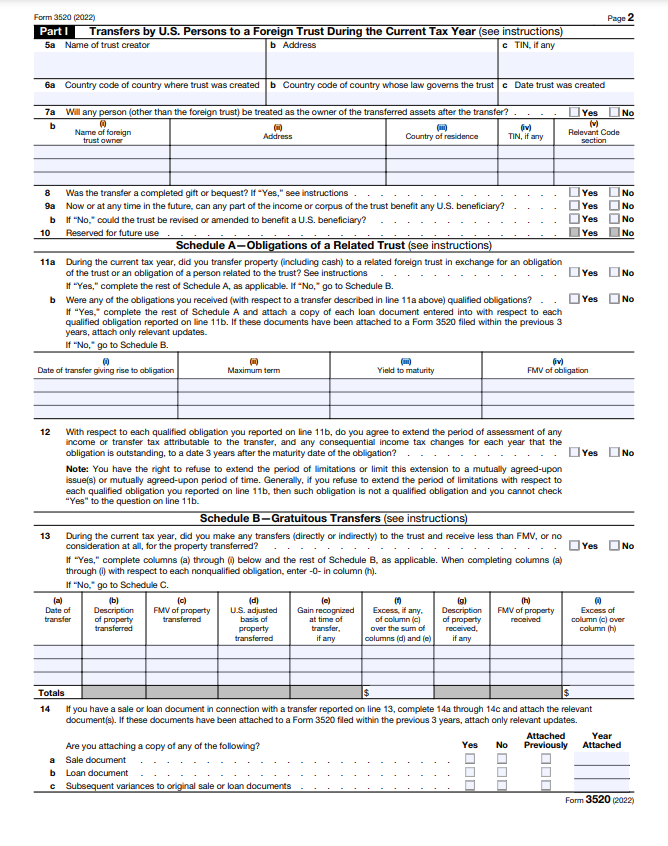

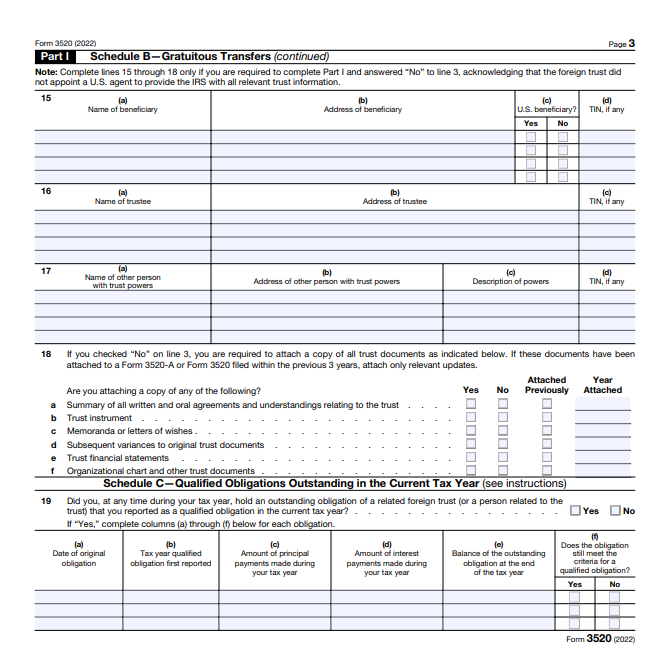

In completing Form 3520, your responsibility is important. This document demands details regarding foreign gifts, trusts, or bequests, and it necessitates your utmost attention to compliance. You must articulate the nature of the gift, diligently quantify its value, and transparently report any associated income. This isn’t merely a procedural requirement; it is an essential step to ensure the accuracy and integrity of your financial disclosures.

Take a moment to scrutinize the intricacies of the trust or estate involved. Specify its country of origin, a crucial facet in navigating the complex landscape of international financial transactions. Furthermore, identify the individuals steering this financial vessel—furnish the names of trustees or executors with precision. Remember, this isn’t just about completing a form; it’s about conveying a comprehensive snapshot of your financial engagements abroad.

In your hands lies the power to present a clear, authoritative account. The language you employ must not only meet regulatory standards but also underscore your commitment to due diligence. By adhering to these directives, you not only fulfill a legal obligation but also empower yourself with a robust financial narrative.

4. Check Thresholds

Make sure that when you’re dealing with transactions, it fit within certain reporting limits. If you’re giving or receiving gifts above a certain amount or getting involved with foreign trusts, you need to fill out Form 3520. This form is essential to reporting these specific transactions accurately. Following these rules isn’t just about paperwork; it’s a way to stay on the right side of the law and avoid any legal issues.

By staying on top of these reporting requirements, you show that you’re responsible and transparent in your financial dealings. Think of it as a way to make sure everything is in order and that you’re doing things by the book to keep your financial situation secure and compliant.

>>>GET SMARTER: Form 8917: What It Is, How to File It

5. Calculate and Report Taxes

In your case, receiving gifts usually doesn’t involve paying taxes. However, when it comes to dealings with foreign trusts, there’s a chance it can affect your taxes. It’s crucial that you grasp these tax implications and report them accurately. Understanding these details is like having a key to safeguarding your financial well-being. Think of it as a roadmap—the more you know, the better you can navigate. Reporting accurately isn’t just a suggestion; it’s a must for being clear about your finances. So, stay informed and keep an eye on these details, especially when dealing with foreign trusts. Your diligence in understanding and reporting can play a big role in managing your finances wisely.

6. Filing Process and Deadline

Form 3520 is a crucial document for tax compliance. It demands a distinct filing, separate from your standard tax return, requiring submission directly to the Internal Revenue Service (IRS). As you navigate this process, remember that the deadline for submitting Form 3520 aligns with your income tax return due date, extensions included.

This distinct filing serves to report specified foreign financial transactions, ensuring full disclosure of assets and adherence to tax regulations. Approach this with meticulous attention, as any oversight could lead to penalties. By submitting this form accurately and promptly, you demonstrate a commitment to financial transparency and compliance. In your hands lies the responsibility to fulfill this requirement, safeguarding your financial standing and maintaining a proactive stance on your tax responsibilities.

7. Penalties for Non-Compliance

Not filling out Form 3520 correctly can lead to serious problems. If you miss it or give incomplete information, you could face big fines or, in some cases, even criminal charges. The key is grasping the filing rules and sticking to them to avoid these penalties.

Think of it like this: imagine Form 3520 as a crucial document you need to get right. If you don’t, you might end up with hefty fines or, in extreme cases, facing legal trouble. So, it’s like a rulebook—if you don’t follow it carefully, there are consequences.

Picture it as a road with clear signs. If you miss a turn or don’t follow the signs (in this case, the filing rules), you might face fines (like a traffic ticket) or, in serious cases, legal trouble (like getting into a more significant issue). Understanding and following these rules is like driving safely to avoid those problems; it’s a way to protect yourself from financial and legal headaches.

Recap

In conclusion, Form 3520 is your passport to global financial compliance and an essential dialogue between you and the IRS. Filing is not just a task; it’s an opportunity to articulate your international financial narrative. You disclose foreign gifts, bequests, and asset ownership with precision, showcasing your financial stewardship.

Stay vigilant with deadlines; time is your ally. Secondly, accuracy is paramount—details matter. Consider seeking professional guidance to navigate intricate scenarios. Like a seasoned traveler, familiarize yourself with the terrain—understand the nuances of FORM 3520, ensuring a seamless financial journey.

As you embark on this financial exploration, remember that Form 3520 is not a mere formality; it’s your narrative etched in financial ink. So, embrace the opportunity, wield your pen of financial transparency, and let each submission be a testament to your global fiscal responsibility. Safe travels through the paperwork trail!

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.