Have you heard of Form 1120S before? – It may sound like just another IRS form, but if you are a business owner, it’s the key that helps you navigate the complex world of taxation hitch free. As a business owner, have you ever felt like you’re in a tax maze, trying to find your way through the jumble of forms and regulations? Well, you’re not alone.

Imagine this: you’ve poured your heart and soul into building your S corporation, navigating the highs and lows of entrepreneurship. However, when tax season arrives, the excitement of running a business may be overshadowed by the daunting task of handling tax obligations.

Amidst the chaos, Form 1120S emerges as your trusted ally, providing structure and clarity in the tax labyrinth. It’s the document that empowers your S corporations to report its financial activity, ensuring transparency and compliance with IRS regulations. Form 1120S serve as the beacon of clarity in the fog of business taxation, as it sheds light on how your S corporations can report its income, deductions, and credits.

In this article, you get to unravel the intriguing world of Form 1120S, exploring why it’s crucial for S corporations, how it simplifies tax reporting, and the essential steps to ensure compliance. Whether you’re a seasoned business owner or a budding entrepreneur, understanding Form 1120S is the key to unlocking the potential of your S corporation while ensuring compliance with the ever-changing tax laws.

So, grab your entrepreneur hat, get ready to decode the tax puzzle, and prepare for an enlightening journey into the realm of business tax filings!

As you ready yourself for a seamless tax season, it is essential that you know;

- What Is Form 1120S?

- Why Do You Need Form 1120S?

- How to File Form 1120S

- Factors to Consider When Filing Form 1120S

Recap

1. What Is Form 1120S?

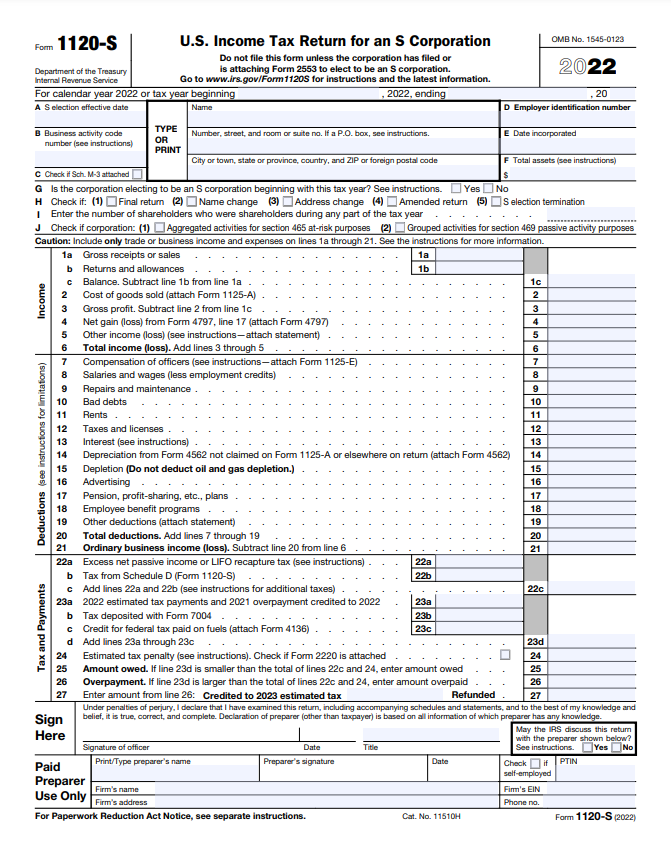

Consider Form 1120S, commonly referred to as the U.S. Income Tax Return for an S Corporation, as the pivotal tax document employed by S corporations in the United States to meticulously document and report financial intricacies to the Internal Revenue Service (IRS). This form encapsulates a comprehensive breakdown of the S corporation’s financial landscape; it details your income, deductions, gains, losses, and various credits.

Operating as a distinct business entity, an S corporation uniquely funnels corporate income, losses, deductions, and credits directly to its shareholders for federal tax considerations. Consequently, shareholders assume the responsibility of incorporating these financial facets into their individual tax returns, rendering the corporation itself exempt from direct federal taxation.

As a conduit for tax reporting, Form 1120S assumes paramount importance in capturing the financial essence of S corporations. Beyond its role in income reporting, this form encapsulates the fundamental nature of your S corporation’s financial health, elucidating the intricate interplay of gains, losses, deductions, and credits.

Form 1120S stands as a cornerstone that ensures your compliance with IRS regulations, delineating the transparent flow of financial information from the S corporation to its individual stakeholders, thereby fostering clarity and adherence to tax norms.

2. Why Do You Need Form 1120S?

Acknowledge Form 1120S as essential for you and your businesses if you are classified as S corporations or LLCs taxed as S corporations. If you’ve filed Form 2553 to declare your business as an S corp or an LLC for S corp taxation, you’ll also need to file Form 1120S. It’s important to remember that Form 1120S is a separate filing submitted to the IRS, not included with your personal tax return, and is typically due on March 15th annually.

3. How to File Form 1120S

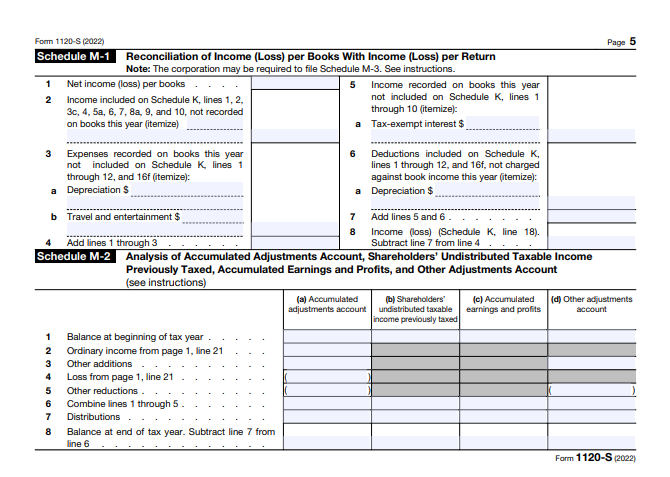

Form 1120S allows you to provide report your income, deductions, credits, and other pertinent information about your S corporation’s financial activity and that is why must be calm and collected when you want to fill the form as it requires you to fill multiple schedules. Nevertheless, Here is a step-by-step guide to help you complete Form 1120S:

i. Gather Necessary Information and Documents

Before you start filling out the form, make sure you have the following information ready:

- The date your business was officially established.

- A list of the products or services your business offers.

- The business activity code for your type of business.

- Employer Identification Number (EIN).

- The date when you chose to become an S corporation. For most businesses that run on a calendar-year basis, this date is usually January 1. If your business operates on a different fiscal year, it’s the first day of that fiscal year.

- A report showing your business’s profits and losses, along with a summary of your business’s financial position.

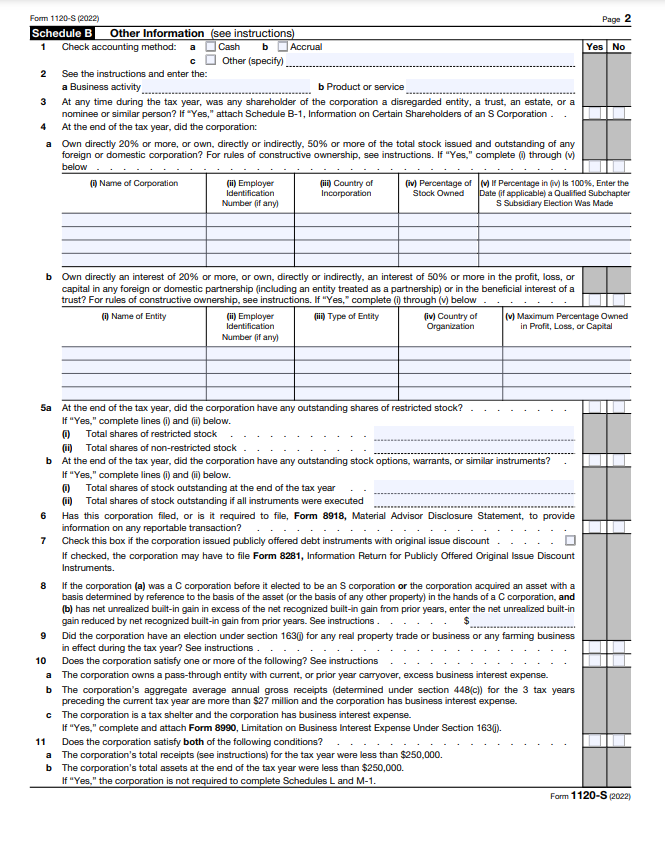

- The method you use to handle your business’s accounting, whether it’s cash-based or accrual-based accounting.

- Any payments you make to independent contractors

ii. Identify the Corporation’s Information

Consider Section A that demands the designation of the applicable box, signifying whether the corporation’s return is an initial, final, or amended submission. Simultaneously, this section necessitates the completion of crucial details including the corporation’s legal name, address, Employer Identification Number (EIN), and additional requested information, forming a comprehensive profile of the corporation’s essential identification markers and ensuring accurate representation within the tax filing process.

iii. Determine the Corporation’s Income

Within Form 1120S, Part I commands that you should make a comprehensive declaration of the corporation’s overall income, encompassing gross receipts, dividends, interest, and diverse sources of revenue, while Part II directs the disclosure of the cost of goods sold associated with the corporation’s offered products or services, if relevant, thereby constituting a thorough portrayal of the corporation’s revenue streams and operational costs.

iv. Calculate Deductions and Expenses

In the process of computing deductions and expenses within Form 1120S, Part III mandates the comprehensive disclosure of deductible expenses, encompassing items like salaries, rent, utilities, insurance, and various other business-related costs, while Part IV facilitates the inclusion of supplementary details concerning the corporation’s activities, serving as an avenue for furnishing any additional pertinent information necessary for a comprehensive representation of the corporation’s financial landscape and operational intricacies.

v. Figure Tax, Credits, and Payments

Within the tax calculation phase delineated by Form 1120S, Part V necessitates the comprehensive determination of the corporation’s tax obligations, encompassing the calculation of tax liability, the reporting of applicable tax credits, and the meticulous documentation of estimated tax payments or potential overpayments. Additionally, Schedule J plays a pivotal role in this process, requiring completion to compute the corporation’s taxable income and delineate the precise nature of the tax liability incurred as a result, serving as an essential step in the accurate computation and settlement of the corporation’s tax responsibilities.

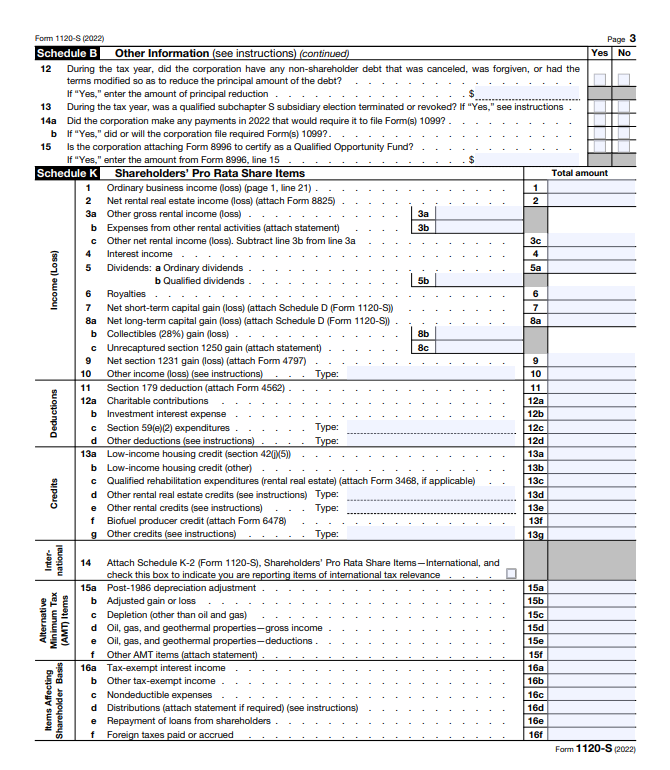

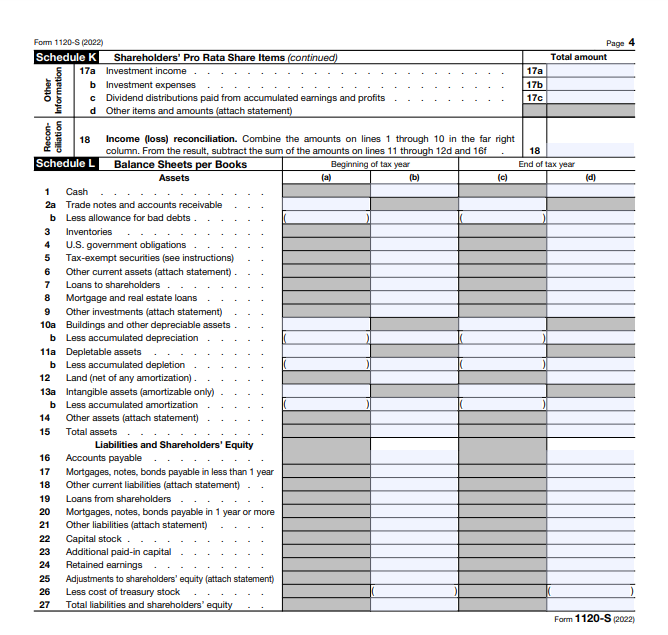

vi. Prepare Shareholder Information

During the shareholder information compilation phase on Form 1120S, Use Schedule K to supply the comprehensive recording of the corporation’s shareholders, detail their respective ownership percentages and pertinent information. Concurrently, make use of Schedule K-1 (Form 1120S) to meticulously outline each shareholder’s allocated share of income, deductions, credits, and other essential financial information, providing a comprehensive breakdown essential for shareholders’ accurate reporting of their individual tax obligations.

vii. Review and File the Form

Double-check all entries, calculations, and supporting schedules to ensure accuracy.

Submit Form 1120S by the due date (usually March 15th for calendar year corporations) to the IRS. You can file electronically or via mail.

>>>PRO TIPS: Federal Tax Credit for Residential Solar Energy

4. Factors to Consider When Filing Form 1120S

Here are some factors to consider when you want to determine whether you should file Form 1120S:

- Business Structure: If your business is classified as an S corporation or an LLC that’s taxed as an S corporation, you will likely need to file Form 1120S. Consider your business to be an S corp if you meet the IRS requirements for an S corporation which includes having 100 shareholders or less and meeting other specific criteria.

- Ownership: If you are a shareholder in an S corporation and the corporation has made a valid election to be taxed as an S corporation, you will need to file Form 1120S.

- Taxation Method: If your business prefers pass-through taxation, where the business’s profits and losses are passed through to the shareholders and reported on their individual tax returns, filing Form 1120S may be advantageous. Pass-through taxation is advantageous as it potentially reduce overall tax liability.

>>>GET SMARTER: Form 8917: What It Is, How to File It

Recap

Remember, Form 1120S, the U.S. Income Tax Return for an S Corporation, stands as the crucial documentation tool you must utilize to meticulously report your financial status to the IRS. This form encapsulates intricate details regarding income, deductions, expenses, tax liabilities, and shareholder information, serving as the cornerstone of an S corporation’s tax obligations.

Obtain a comprehensive understanding of your corporation’s financial landscape as Form 1120S necessitates it, alongside meticulous attention to detail, and adherence to IRS regulations.

Seek for professional guidance as it prove to be invaluable in navigating the complexities of Form 1120S, ensuring accurate filings, and leveraging the advantages of S corporation taxation while maintaining compliance with regulatory requirements.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.