Do you want to navigate the intricate landscape of corporate tax filing with confidence, ensuring your business maximizes its financial potential? Are you ready to unlock the secrets of Form 1120, the U.S. Corporation Income Tax Return, to propel your company toward success?

Embark on a journey through the essential steps of filing Form 1120, demystifying the complexities and providing you with the tools to optimize your tax strategy. From determining your filing status to calculating your tax liability, each step is a strategic move toward financial empowerment. Dive into the world of Form 1120 and transform the way you approach your business’s tax obligations. Get ready to make informed decisions that not only keep you in compliance with tax regulations but also pave the way for your business’s financial prosperity.

To ensure a seamless experience in filing Form 1120:

- Determine Your Filing Status

- Gather Essential Information

- Download Form 1120

- Complete the Form

- Attach Supporting Documents

- Check for Accuracy

- Calculate Your Tax Liability

- Complete Additional Forms

- File Your Tax Return

- Keep Copies for Your Records

- Consider Seeking Professional Advice

Recap

1. Determine Your Filing Status

To master the intricacies of corporate tax filing, begin by exploring the various filing statuses available for your business. This initial step is crucial, as it lays the foundation for how your corporation’s income will be taxed. Common filing statuses include C corporations, which are subject to the standard corporate tax rates, and entities with certain elections, such as S corporations, which pass their income, deductions, and credits through to their shareholders.

Understanding these distinctions is vital because it directly impacts the tax treatment your business receives. For instance, while C corporations face double taxation—taxation at both the corporate and individual levels—S corporations allow income to “pass through” to shareholders, who report it on their tax returns. Additionally, certain elections may be available, like the Qualified Subchapter S Subsidiary (QSub) election, providing even more tailored tax approaches based on your corporation’s structure and objectives.

2. Gather Essential Information

To ensure a seamless experience when filing Form 1120, meticulously gather essential information about your company’s financial activities. This involves collecting a comprehensive set of documents, including but not limited to financial records, income statements, expense details, and any relevant transaction documentation. Imagine these documents as the building blocks of your tax return; the more organized and detailed they are, the smoother the construction of your tax filing.

For instance, having clear records of income sources, categorized expenses, and transaction details not only expedites the completion of Form 1120 but also minimizes the chances of errors or omissions. A well-organized compilation of financial information not only simplifies the current filing but also lays the groundwork for future financial planning and strategic decision-making for your business.

3. Download Form 1120

To navigate the complexities of business tax regulations, access Form 1120 from the official IRS website or through authorized tax software. This critical step sets the foundation for a smooth filing process. The official IRS website provides a reliable source for the most up-to-date version of the form, ensuring that you’re using the correct and current template.

Authorized tax software, approved by the IRS, can offer user-friendly interfaces, step-by-step guidance, and automatic updates, simplifying the entire filing process. Regularly check for updates or revisions to the form to stay in compliance with any changes in tax regulations. A proactive approach to accessing the form not only saves time but also reduces the likelihood of errors in your tax return, contributing to a more accurate and efficient filing experience.

>>>PRO TIPS: Charitable Contributions: Everything You Must Know

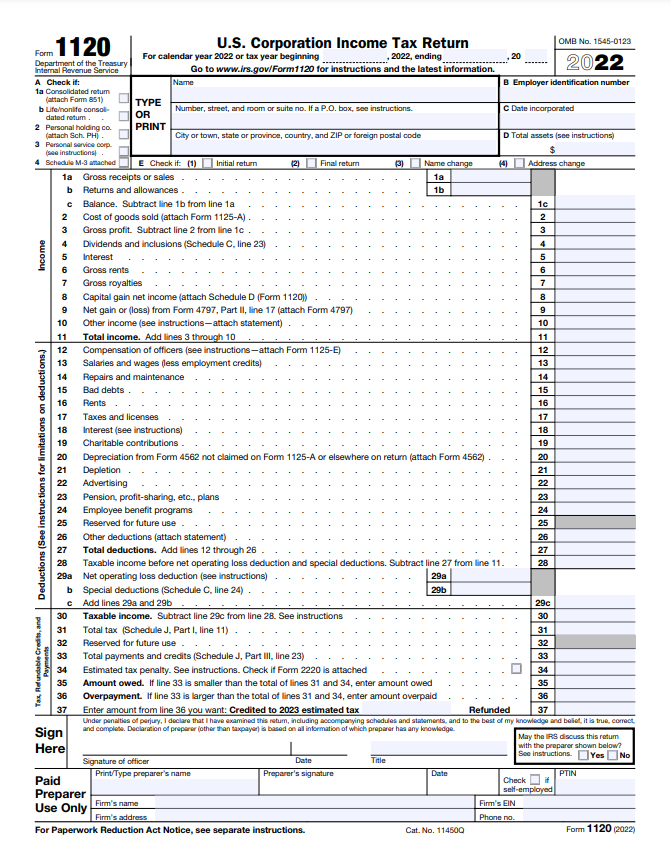

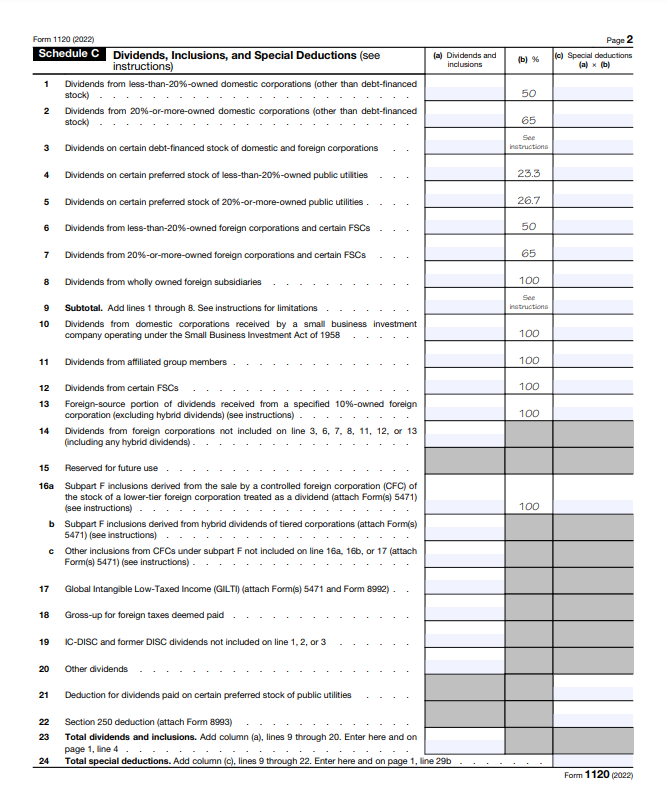

4. Complete the Form

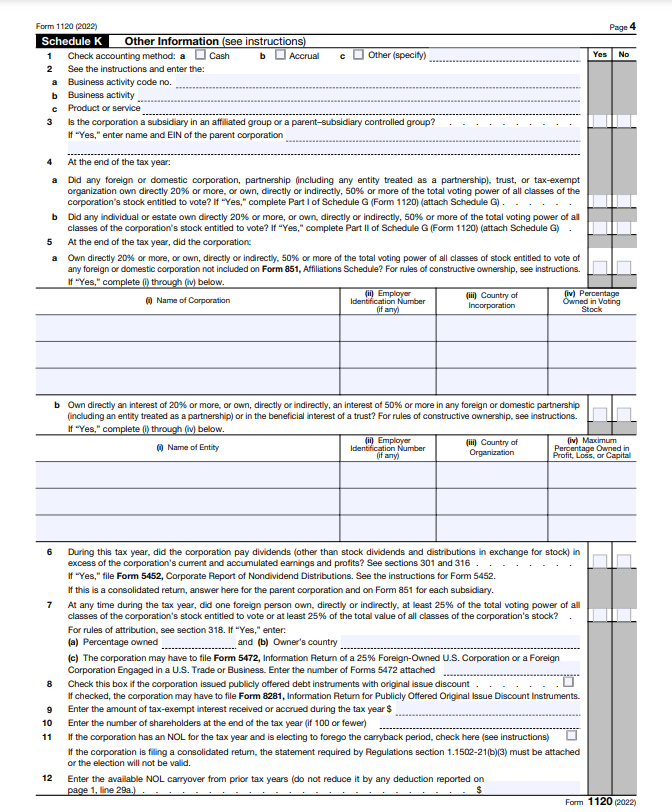

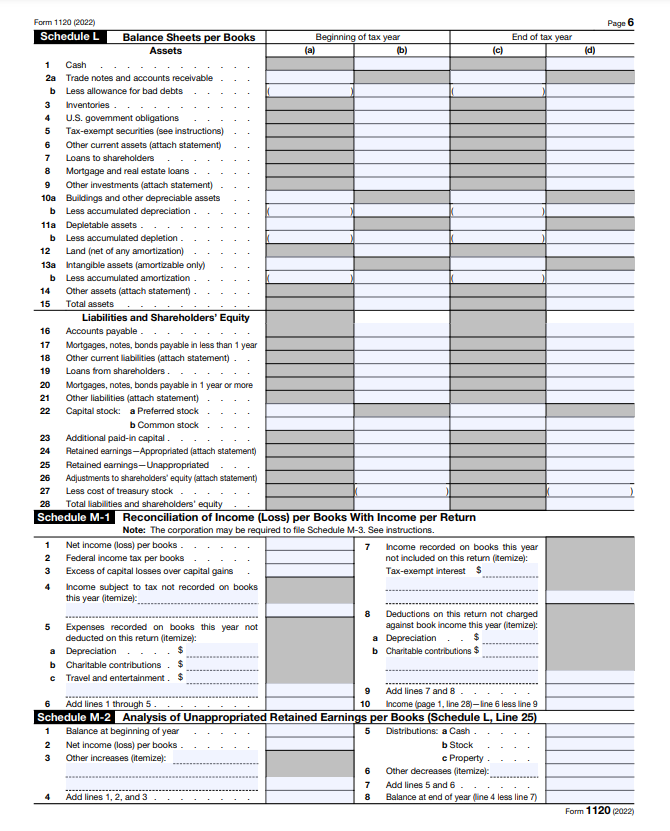

To optimize your experience of completing Form 1120, diligently fill out the form and ensure every section is accurately populated with your company’s financial information. Thoroughly include details about income, leaving no revenue stream unaccounted for, and comprehensively list deductions and credits applicable to your business.

Navigate through the form meticulously and follow each instruction with precision. Pay special attention to specific lines and schedules that might be relevant to your business activities, ensuring that no potential tax advantage is overlooked. Remember, the completeness and accuracy of the financial information you provide play a crucial role in determining your tax liability and potential benefits.

5. Attach Supporting Documents

To make the process of filing Form 1120 more comprehensive and robust, gather all your supporting documents. These should go beyond mere inclusion and be organized with clarity. For instance, if you’re claiming specific tax credits, such as the Research and Development Tax Credit, ensure that you attach detailed documentation illustrating your qualifying research activities and related expenses.

If your business is eligible for deductions, especially if you qualify for business expenses, provide explicit statements and receipts to substantiate these claims. The key is to create a clear and well-documented trail that not only supports the figures entered on the form but also aligns with the Internal Revenue Service’s (IRS) expectations.

6. Check for Accuracy

To ensure a seamless experience when filing Form 1120, review the completed form and supporting documents for accuracy. This meticulous review serves as a proactive measure against potential delays or issues during the processing of your return. Double-check the numerical entries and ensure they align with your financial records.

For instance, reconciling your reported income with your income statements and verifying deductions against documented expenses can prevent discrepancies. This attention to detail not only enhances the accuracy of your filing but also demonstrates diligence in compliance, reducing the likelihood of complications in the IRS review process.

7. Calculate Your Tax Liability

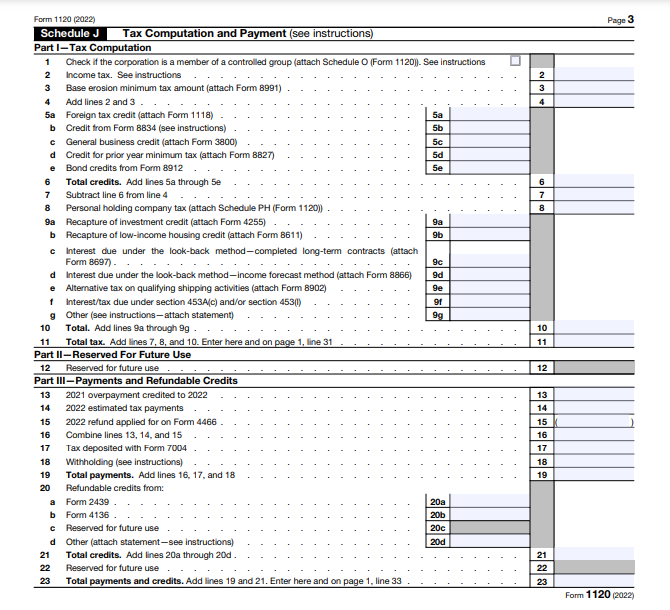

To optimize your business tax strategy, delve into the specific requirements for calculating your tax liability. Understand the applicable tax rates and how they relate to your taxable income. This knowledge is pivotal in optimizing your tax position.

Consider the nuances of available credits and deductions that can significantly impact your final tax liability. For instance, if your corporation engages in research and development activities, you might be eligible for the Research and Development Tax Credit. Conversely, failing to account for eligible credits or deductions could result in overpaying your tax bill.

>>>GET SMARTER: Business Tax Cheat Sheet on IRS Forms, Schedules and Resources

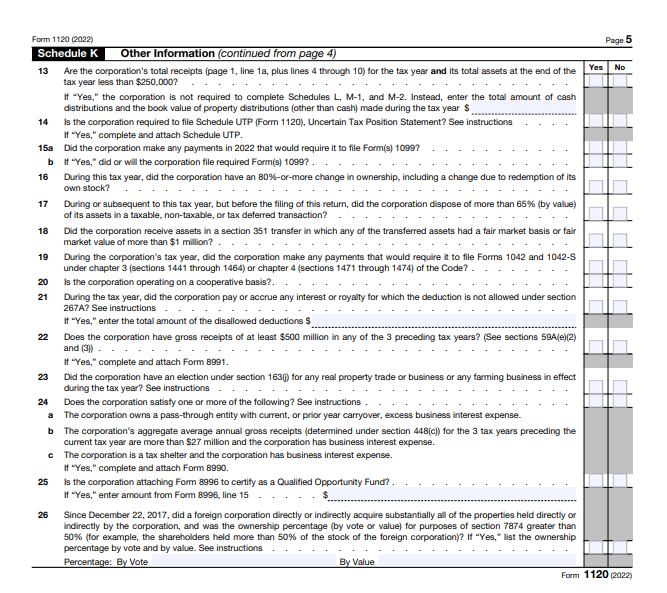

8. Complete Additional Forms

To optimize your business tax strategy, depending on your corporation’s activities and characteristics, you may need to fill out additional forms or schedules. For example, if your business engages in international transactions, you might need to complete Schedule J to report income from controlled foreign corporations.

Similarly, if your corporation qualifies for certain credits, such as the research credit, you’ll need to file additional forms like Form 6765. Review the instructions carefully to help you identify these supplementary forms, ensuring a comprehensive and accurate tax filing that maximizes your available benefits.

9. File Your Tax Return

To ensure a smooth and timely submission of your tax return, submit your completed Form 1120 and any additional forms to the IRS with careful consideration of the available filing options. If you opt for electronic filing, take advantage of the convenience and efficiency it offers. Many businesses prefer this method for its speed and the immediate acknowledgment of receipt.

Conversely, if you choose traditional mail, ensure that all documents are appropriately organized and securely packaged. Be mindful of the filing deadline to avoid penalties and interest charges. Timely submission not only demonstrates your commitment to compliance but also allows ample time for any potential inquiries or adjustments, contributing to a hassle-free tax season for your corporation.

10. Keep Copies for Your Records

To make your experience of filing Form 1120 more efficient and financially secure, you should retain copies of your tax return and all supporting documents for your records. This is crucial for future reference or in the event of an audit. Imagine a scenario where, a couple of years down the line, you need to revisit your financial history or respond to an audit inquiry.

Having a comprehensive set of records at your fingertips can save you from the stress of reconstructing past financial details. These records serve as a robust financial archive, offering not only proof of compliance but also valuable insights into your business’s financial trajectory. Additionally, they provide a tangible resource if you decide to seek professional advice in the future, offering a clear picture of your financial activities and aiding in any financial planning or strategy adjustments.

11. Consider Seeking Professional Advice

If your corporation’s financial situation is complex, consider seeking advice from a tax professional. Navigating intricate tax scenarios requires specialized knowledge, and a tax professional can offer tailored insights to optimize your tax position. Their expertise extends beyond mere compliance; they can identify potential deductions, credits, and strategies that align with your business goals. Moreover, in the dynamic landscape of tax regulations, staying updated is crucial, and tax professionals specialize in interpreting and implementing these changes.

Recap

In conclusion, mastering the art of filing Form 1120 involves a strategic and meticulous approach to corporate tax responsibilities. From determining your filing status to considering professional advice, each step plays a crucial role in ensuring accuracy, compliance, and optimal financial outcomes for your corporation.

By exploring the intricacies of corporate tax filing, you empower yourself to navigate the complexities efficiently. Seamless experiences in filing Form 1120 stem from a comprehensive understanding of business tax regulations, safeguarding financial interests, and staying proactive against common pitfalls.

Remember to keep abreast of tax deadlines, protect your business’s financial health, and explore tax-efficient practices. Whether you’re optimizing your tax strategy or seeking compliance in a complex financial landscape, seeking advice from a tax professional remains a valuable choice.

Their guidance extends beyond compliance, providing a pathway to strategic financial management and potential growth opportunities. By embracing these steps with diligence and dedication, you not only fulfill your tax obligations but also lay a foundation for your corporation’s financial success and resilience.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.