Have you ever found yourself with income that doesn’t neatly fit into the standard job pay check? Perhaps it’s from freelance work, rental properties, or even a lucky win – all adding colour to your financial picture. Yet, when tax time rolls around, the question arises: How do you account for these diverse earnings? That’s where Form 1099-MISC comes in – the secret weapon in the battle of tax reporting. This unsung hero ensures that every dollar from these non-traditional sources is accurately reported, keeping your financial house in order and the tax process smooth.

It’s the document that ensures every dollar you earn from these unconventional sources is accounted for, keeping your financial life in order and the taxman at bay. Form 1099-MISC reports payments other than nonemployee compensation made by a trade or business to others.

Form 1099-MISC is a key tool for reporting various types of income, and it’s essential to understand when and how to use it. Form 1099-MISC is an important IRS form used to report various types of incomes. It is crucial for you to file this form whether you are a payer or a recipient to ensure accurate reporting of income.

If you’re scratching your head trying to comprehend what it is, how to file it, and what to watch out for, fear not, as this article is a sure way for you to unravel the mystery of Form 1099-MISC, explore what it is, why it matters, and how to navigate its complexities with confidence.

So, grab a cup of coffee, get cozy, and embark on a journey to demystify the world of miscellaneous income reporting!

As you read on, you will understand;

- What Is Form 1099-MISC?

- How to File Form 1099-MISC?

- What to Look Out for When Filing It

Recap

1. What Is Form 1099-MISC?

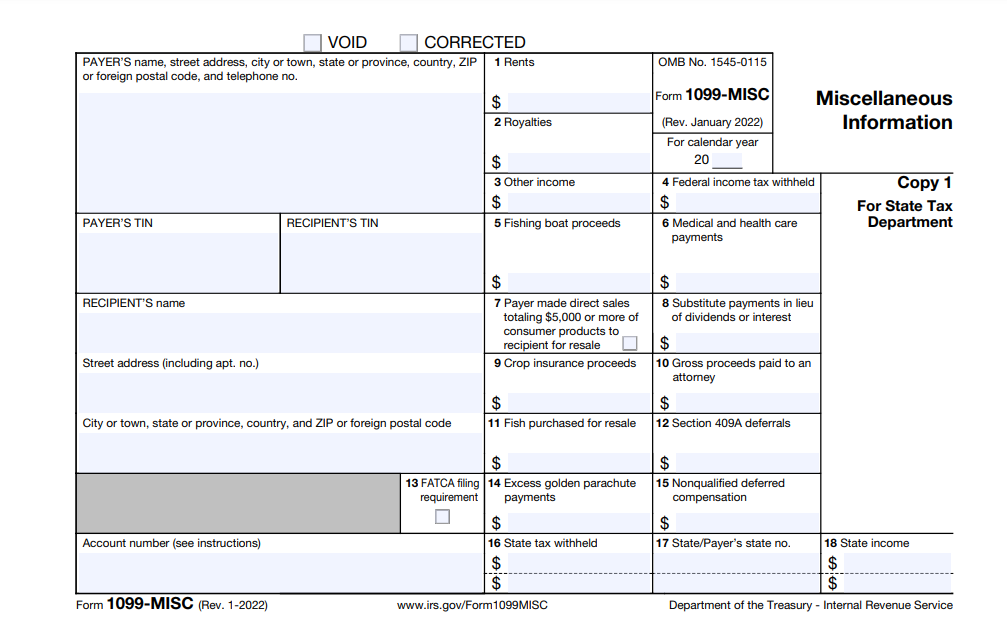

Think of Form 1099-MISC as a document the IRS uses to track miscellaneous income that individuals receive throughout the year, apart from their regular salary. It’s the paperwork used to report income earned as a freelancer, independent contractor, or from other sources and certain miscellaneous compensation including rent, royalties, prizes, and awards, healthcare payments, and payments to an attorney.

A 1099-MISC form is one of many in the 1099 series and among those commonly used. Taxpayers receive 1099s, including Form 1099-MISC, shortly after the end of the tax year and use the information to report the income that they received.

You need to file Form 1099-MISC for each person to whom you have paid at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest, or at least $600 in rents, prizes, awards, other income payments, medical and health care payments, crop insurance proceeds, cash payments for fish, and more. Additionally, it’s used to report direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

2. How to File Form 1099-MISC?

If you’re a freelancer or an independent contractor, chances are you’ll be acquainted with this form. But if you’re receiving one for the first time, don’t panic. If you find yourself in the position where you need to file Form 1099-MISC, here’s a basic breakdown of the process:

i. Gather Information:

Ensure that before you dive into filing Form 1099-MISC, your initial task is to gather a comprehensive record of all payments made to individuals or businesses throughout the tax year. This involves meticulous organization to ensure accuracy in reporting.

Begin by compiling data on payments made either to you or that you give to freelancers, independent contractors, or service providers, surpassing the $600 threshold. Include payments for services such as professional fees, rent, prizes, awards, and royalties. Gather details like the recipient’s name, address, Taxpayer Identification Number (TIN), and the total amount paid.

To streamline this process, maintain a centralized system or utilize accounting software that tracks outgoing payments. Ensure all records are up-to-date and cross-verify them for accuracy against invoices, receipts, or any formal agreements.

ii. Obtain Form 1099-MISC:

To acquire this form, you have several options for accessibility and convenience. Firstly, you can download the form directly from the official IRS website, where it’s readily available for printing. Alternatively, numerous tax software programs offer Form 1099-MISC as part of their services, allowing you to generate and fill out the form electronically. These software options often guide you through the process, reducing errors and ensuring compliance with the IRS regulations.

Additionally, some physical locations, such as post offices or public libraries, might have copies of the form available for pickup during the tax season.

It’s essential to choose the method that aligns best with your preferred filing approach and ensures prompt access to the necessary paperwork.

iii. Fill Out the Form:

Begin by entering your information in the “Payer” section, providing your name, address, and Taxpayer Identification Number (TIN). Move to the recipient’s section, input their name, address, and TIN or Social Security Number (SSN). Never forget that to completing Form 1099-MISC demands precision and attention to detail in recording essential information about the recipient and the income disbursed.

Ensure absolute accuracy in these details, as any discrepancies might lead to complications or potential penalties. Next, specify the type of payment made in the appropriate box, such as “Rents,” “Royalties,” “Nonemployee Compensation,” or other relevant categories.

Enter the total amount paid during the tax year, clearly documenting each category of income separately as required by the IRS.

Double-check all entered information to avoid errors before submission, as inaccuracies might trigger IRS inquiries or delays in processing.

iv. Submit to the IRS and Recipient:

Send Copy A of the form to the IRS, ensuring compliance with their submission deadlines. This can be accomplished either by mailing the form or by utilizing the IRS’s e-filing system, depending on your preferred method and the number of forms being filed.

Simultaneously, furnish Copy B of the form to the recipient, ensuring they receive this documentation detailing the income they’ve earned from you throughout the tax year.

Remember, timing is crucial, so adhere to the IRS’s specified deadlines to avoid potential penalties or inquiries.

When it comes to filing, accuracy is crucial. Make sure all information on the form is correct. Incorrect figures can raise red flags and potentially lead to unwanted attention from the IRS.

>>>PRO TIPS: Federal Tax Credit for Residential Solar Energy

3. What to Look Out For When Filing Form 1099-MISC

When filing Form 1099-MISC, you should be aware of a few key points to ensure compliance and accurate reporting:

- Ensure you meet the deadlines for both filing with the IRS and providing copies to recipients. Late filings can result in penalties.

- Double-check all the information provided on the form to ensure its accuracy and completeness.

- Verify the recipient’s Taxpayer Identification Number (TIN) to avoid penalties for incorrect information.

- Note that there might be specific state filing requirements as well. Some states have their own 1099 filing requirements, so it’s essential to check and comply with these regulations.

- Consult a professional, if you’re unsure about any aspect of filing Form 1099-MISC. Consider seeking advice from a tax professional or accountant.

- Avoid misclassification by all means. The most common error people encounter when dealing with Form 1099-MISC is misclassification. This happens when you’re wrongly classified as an independent contractor instead of an employee or vice versa. If you receive a 1099-MISC but believe you should have been classified as an employee, it’s crucial to address this with the payer. Misclassification can lead to discrepancies in tax payments and benefits, so it’s essential to get it right.

>>>GET SMARTER: Form 8917: What It Is, How to File It

Recap

Form 1099-MISC plays a crucial role in the accurate reporting of various income payments, and understanding how to file it is essential for both payers and recipients.

Form 1099-MISC might seem intimidating at first glance, but with a bit of understanding and organization, you can navigate it smoothly. Remember, accuracy and attentions to detail are your allies. Keep track of your income, communicate promptly with payers in case of discrepancies, and seek expert advice when needed.

As tax season approaches, arm yourself with knowledge, gather your paperwork, and face Form 1099-MISC with confidence. Embrace the process, and you’ll find that tackling this form isn’t as daunting as it seems.

Additionally, failing to report income from a 1099-MISC on your tax return is a big no-no. The IRS receives a copy of this form too, so omitting it from your return might lead to penalties or an audit. Make sure to report all income accurately to avoid any unwelcome surprises.

By following the guidelines and being cognizant of important details when filing this form, you can ensure compliance with IRS requirements and contribute to a smooth tax-filing process.

So, fear not the 1099-MISC—face it, file it, and conquer tax season like a pro!

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.