As a self-employed individual, you navigate a unique financial landscape, and the 1099-K is a significant document in this realm. This form is issued to you by payment settlement entities, like PayPal or credit card companies, detailing your transactions that exceed a certain threshold.

You receive this form if you exceed $20,000 in gross payments and surpass 200 transactions annually. This document plays a pivotal role in your tax reporting, providing you with an overview of income you received through electronic payments.

Verify each detail on the form, confirming its accuracy against your own records. This article will guide you on how to accurately report your income on your tax return so you can ensure compliance with IRS regulations and avoid discrepancies in reporting or potential audits.

Form 1099-K Decoded for the Self-Employed:

- Form 1099-K Overview

- Self-Employment Income

- Payment Settlement Entities

- Payment Threshold Explanation

- Verification Importance

- Eligible Deductions

- How to File

- Avoiding Errors

Recap

1. Form 1099-K Overview

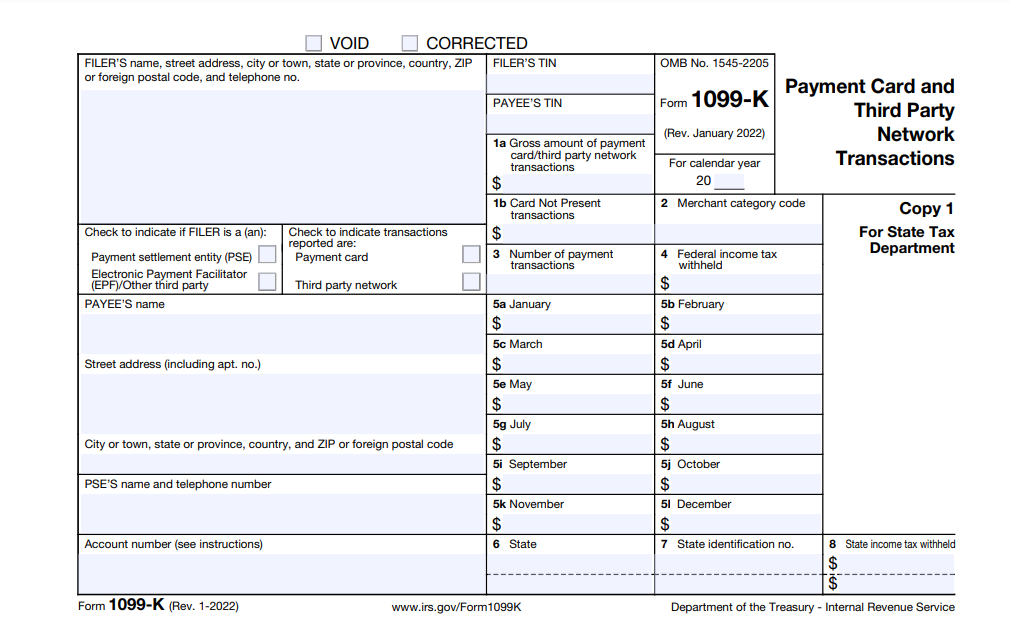

Form 1099-K serves as a critical financial document for self-employed individuals like you. It’s issued by payment settlement entities, encompassing all your electronic transactions. This form captures payment for sales you make or services you provide via credit cards, PayPal, or other payment processors.

If you surpass a $20,000 threshold or complete over 200 transactions annually, you receive this form. Its purpose is to provide you with an overview of your income from electronic payments. Remember, this isn’t a tax calculation but rather an informational summary. The IRS receives a copy to ensure transparency in the income you report.

Make sure you verify its accuracy against your records, ensuring all details align. This form does not signify your taxable income outright; it’s your responsibility to report the income you earn accurately and calculate the tax you owe during tax filing. Proper handling of this form ensures compliance, helping you minimize audit risks and facilitating efficient tax management.

2. Self-Employment Income

As a self-employed individual, your income differs from traditional employment. It’s the money you earn through your business endeavors, whether freelance work, consulting, or running your own enterprise. This income isn’t subjected to standard payroll withholding taxes, leaving you responsible for accurately reporting and paying taxes on this earned income.

Your income sources might vary widely—consulting fees, product sales, service charges, or royalties—all contributing to your overall self-employment income. Document and categorize these earnings because it is crucial for tax purposes. You must track this income diligently throughout the year to ensure accurate reporting during tax filing.

Remember, even occasional or irregular income counts. It’s imperative you understand that the IRS requires you to report and pay taxes on your total self-employment income, making thorough record-keeping essential. You may consider professional advice if you’re uncertain about any reporting aspects.

3. Payment Settlement Entities

Payment settlement entities are vital entities in your financial landscape as a self-employed individual. It includes various platforms that process the electronic payments you receive in your business operations. Platforms like PayPal, credit card companies, and other payment processors fall into this category.

These platforms play a pivotal role in your financial transactions, as it is responsible for facilitating and processing your customers’ payments to you. The role extends beyond simply transferring funds; it also tracks and compiles the details of these transactions for tax purposes.

It’s essential you understand that these entities issue the Form 1099-K to you if your annual transactions surpass a certain threshold. These platforms serve as intermediaries ensuring transparency in your income reporting to both you and the IRS.

Make sure you stay informed about the guidelines and any updates these entities provide regarding transactions and reporting criteria because it is crucial for accurate financial management.

4. Payment Threshold Explanation

The payment threshold signifies a crucial milestone in your financial journey as a self-employed individual. It represents the minimum limit set by payment settlement entities, like PayPal or credit card companies, to trigger the issuance of Form 1099-K to you.

If your total payments from these platforms exceed $20,000 and involve more than 200 transactions within a calendar year, you’ll receive this form. This threshold acts as a marker, indicating when your financial transactions reach a level that necessitates additional reporting to both you and the IRS.

Take note of this threshold because it marks the point at which these entities compile and report your transaction details. Don’t forget to keep track of your transactions throughout the year to stay informed about approaching this threshold. Being aware of this limit allows you to prepare for the potential receipt of Form 1099-K and ensures accurate income reporting for tax purposes.

5. Verification Importance

Verification stands as a critical step you need to carry out to manage Form 1099-K as a self-employed individual. It’s your responsibility to ensure the accuracy of the information provided on this form. Take the time to cross-check each detail against your own records.

Make sure you review the reported amounts, transaction counts, and any other relevant data to guarantee consistency and correctness. This verification process is pivotal, as discrepancies could arise due to various reasons, like returned goods or canceled transactions, affecting your reported income.

Ensuring accuracy eliminates potential issues during tax filing and minimizes the chances of audits or inquiries from the IRS. Regularly monitor and verify this information throughout the year as it aids in addressing any discrepancies promptly.

Utilize your records as a reference point for comparison and keep it organized to simplify this verification process. When you take these steps, it reinforces the reliability and accuracy of your reported income, maintaining compliance with tax regulations.

6. Eligible Deductions

As a self-employed individual, eligible deductions hold substantial importance when you’re reporting your income from Form 1099-K to the IRS. While this form doesn’t directly mention deductions, it plays a significant role in reducing your taxable income.

As you report your self-employment income, you’re entitled to deduct various expenses related to your business operations. These deductions encompass expenses like office supplies, advertising costs, travel expenses, and professional fees. Additionally, you can consider deductions for health insurance premiums, retirement contributions, and a portion of your home utility costs if you have a dedicated workspace in your house.

However, it’s crucial you adhere to IRS guidelines and ensure these deductions are legitimate business expenses. Accurately reporting eligible deductions decreases your taxable income, potentially reducing the overall tax burden associated with your self-employment income. Make sure you keep meticulous records of these deductions to support your claims during tax filing, ensuring compliance while maximizing allowable deductions.

7. How to File

Here is a detailed step by step process on how to report Form 1099-K:

- Gather Records: Collect all records detailing income from payment settlement entities, like PayPal or credit card companies, including supporting documents for deductible expenses.

- Review Form: Check the accuracy of your Form 1099-K against your own transaction records and financial statements.

- Verify Compliance: Ensure the information matches your records to avoid discrepancies.

- Report Income: Input the income amount and other required information as indicated on your Form 1099-K in the appropriate section of your tax return.

- Claim Deductions: Identify eligible business expenses and deductions to reduce your taxable income.

- Submit Return: File your tax return with the IRS, either electronically or via mail.

- Maintain Records: Keep copies of your Form 1099-K and supporting documents for your records.

- Seek Assistance: Consider consulting a tax professional for complex reporting or if you’re unsure about any details.

- Plan Ahead: Prepare for next year’s tax obligations based on this year’s filing experience.

8. Avoiding Errors

Make sure you avoid the following errors when reporting your Form 1099-K to the IRS:

- Neglecting Records: Maintain detailed transaction and income records.

- Overlooking Deductions: Claim eligible business expenses fully.

- Disregarding Thresholds: Ensure you note the payment limit that triggers reporting.

- Ignoring Discrepancies: Verify Form 1099-K against your own records.

- Misinterpreting Guidelines: Follow the IRS rules for self-employment income reporting.

- Omitting Updates: Always stay informed about reporting changes.

- Misplacing Documents: Keep all your tax-related records organized.

>>>GET SMARTER: Form 5498-ESA: What It Is, How to File It

Recap

It’s vital you understand Form 1099-K as a self-employed individual. It summarizes your electronic transactions from payment settlement entities like PayPal. You must report this income accurately on your tax return, ensuring compliance. Verification against your records is also crucial. Don’t forget to claim deductions as it can reduce your taxable income legitimately.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.