Have you ever wondered about that Form 1095-B. Probably you see some of your colleagues filling it out and you are wondering what is it that they are not telling you about Form 1095-B, the answer is A LOT! Understand that Form 1095-B is pretty important. Well, here is a lowdown on this form.

Form 1095-B is like a backstage pass to your health coverage story. It’s not something you file directly with your taxes, but it’s the golden ticket that confirms you had health insurance coverage during the year. This little piece of paper holds the details about when you, your family, or dependents were covered, and of a truth, understanding it can save you a bunch of headaches come tax season.

Form 1095-B is a nifty little tax document that tells you and the IRS whether you had the minimum essential health coverage needed to meet the requirements of the Affordable Care Act. In other words, it’s all about making sure you had health insurance, and it plays a role in determining if you’re eligible for certain tax benefits.

But hey, it’s not just about taxes; this form can also help you figure out your health insurance game and might even unlock some benefits or exemptions that could be hiding in plain sight. It’s an important piece of the puzzle that ensures everyone is doing their part when it comes to healthcare and taxes. Curious to know more? Buckle up because you are about to take a dive into the world of Form 1095-B – your backstage pass to understanding your health coverage!

As you read on, prepare you mind to be enlightened about;

- What Is Form 1095-B?

- How to File Form 1095-B

- What Are the Benefits of Form 1095-B?

- How to Use Form 1095-B

Recap

1. What Is Form 1099-MISC?

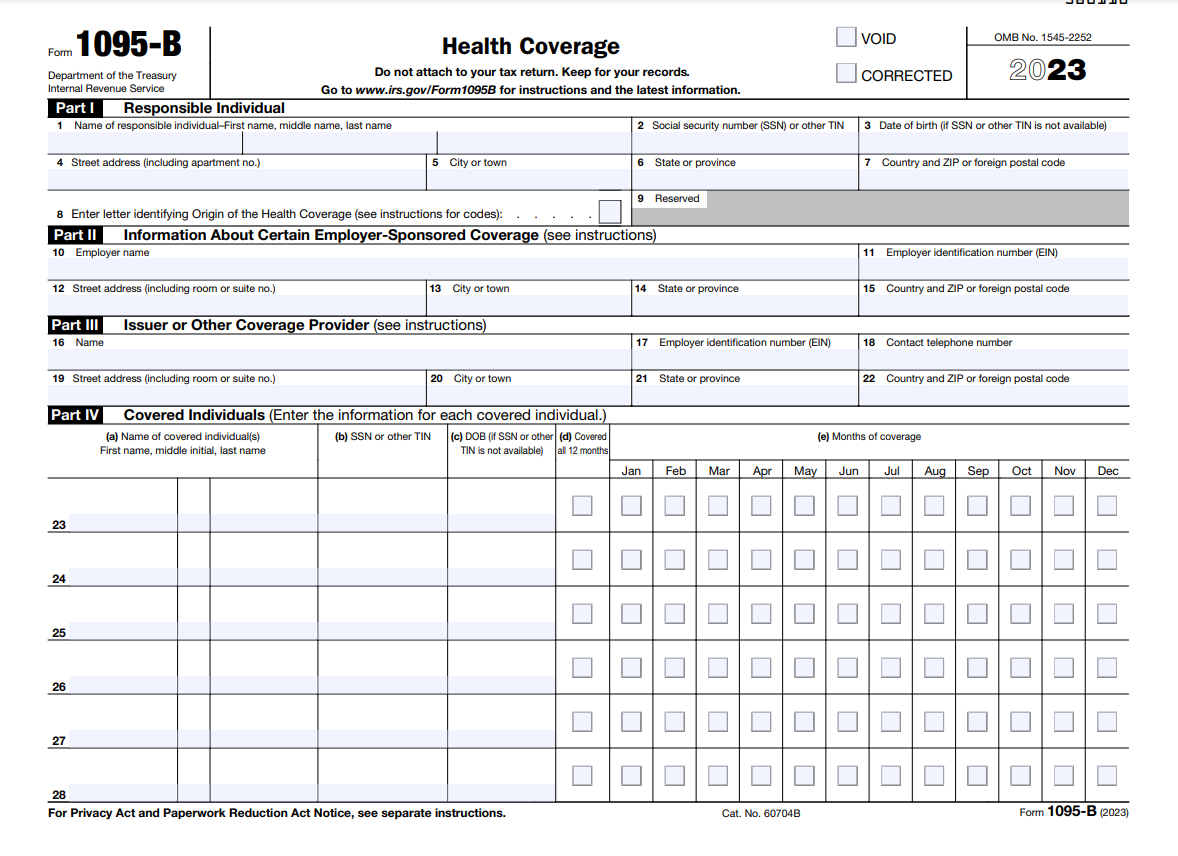

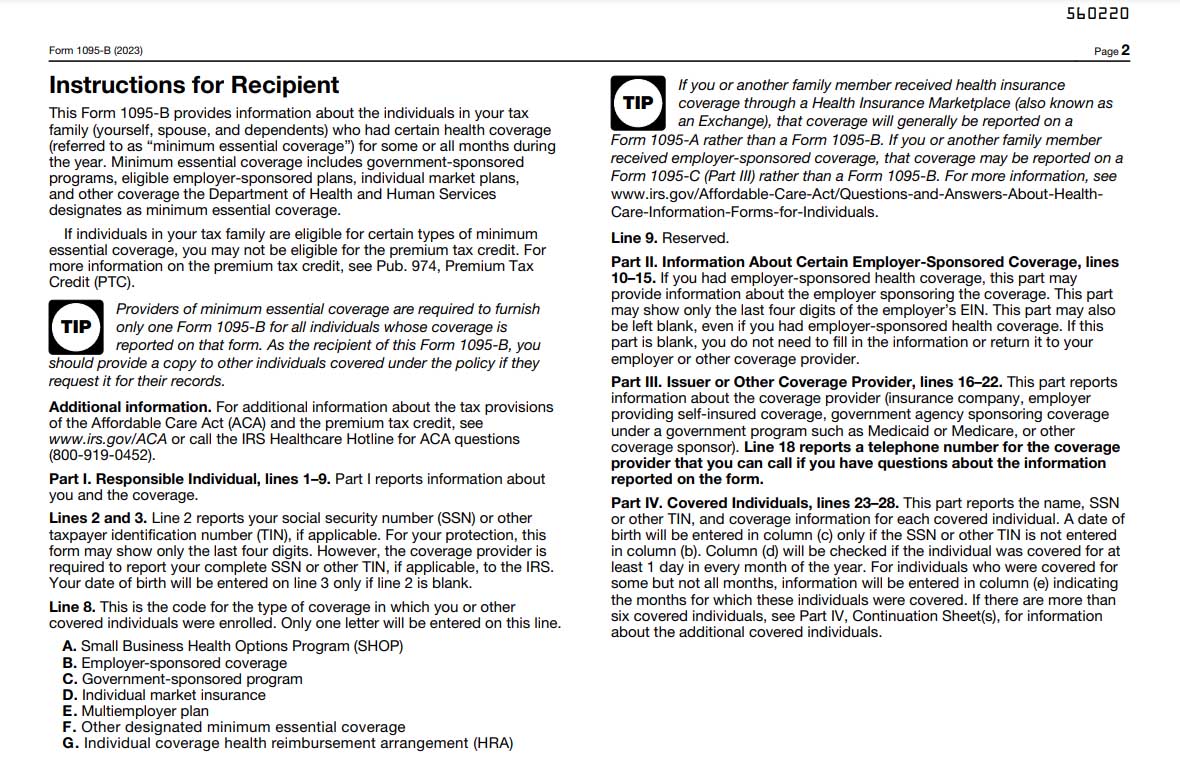

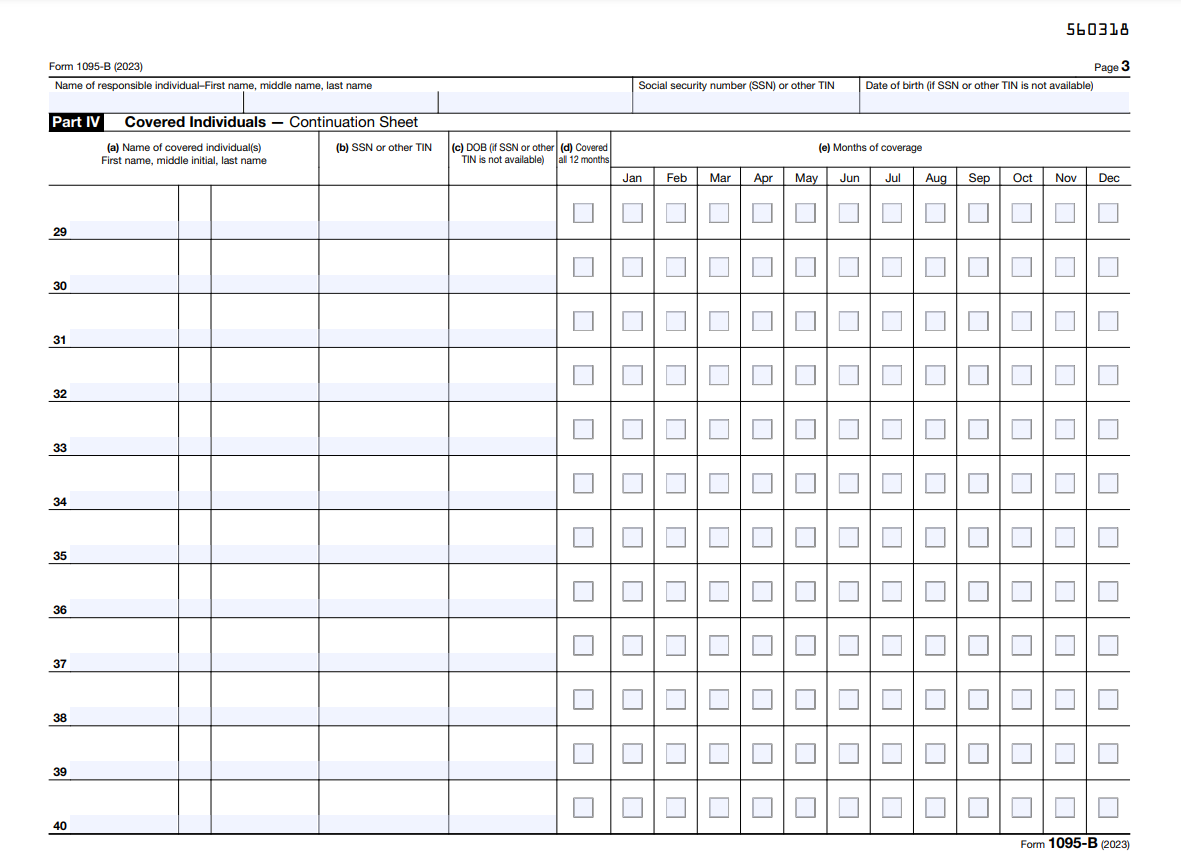

Form 1095-B is a tax form used in the United States to report information about minimum essential health coverage. Form 1095-B is a tax form that reports the type of health insurance coverage you have, any dependents covered by your insurance policy, and the period of coverage for the prior year. It is filed by providers of health coverage, such as insurance companies or employers, to report information for each individual they cover.

The form includes details about the type of health insurance coverage, the period of coverage for the prior year, and any dependents covered by the policy. It is used to verify on your tax return that you and your dependents had minimum qualifying health insurance coverage. Form 1095-B is a tax form that reports information about your health coverage throughout the year. It is typically provided by health insurance companies, self-insured employers, or other coverage providers.

Form 1095-B, “Health Coverage,” is a tax form that provides information about health coverage provided to individuals by insurance providers, government agencies, and self-insured employers. It indicates whether you or your dependents had Minimum Essential Coverage (MEC) during the tax year in compliance with the Affordable Care Act (ACA) requirements.

2. How to File Form 1095-B

If you’re an individual who needs to file Form 1095-B, here are some steps you might follow:

- Receive Form 1095-B: You should receive this form from your insurance provider, government agency, or employer by early February. It will outline the months during the previous year in which you had coverage

- Keep it for your records: You don’t need to file Form 1095-B with your tax return, but keep it in your records as proof of health coverage.

- Use information for tax purposes: Use the information provided on Form 1095-B to complete your tax return. This form helps verify whether you and your dependents had qualifying health coverage for each month during the tax year.

- Prepare your tax return: When filing your tax return, you will need to indicate whether you and your dependents had minimum essential coverage throughout the year. If you had coverage for the entire year or qualified for an exemption, you generally won’t face any penalties related to the Affordable Care Act (ACA).

- Keep other forms handy: You may also receive Form 1095-C if you were enrolled in an employer-sponsored health plan. This form is sent to employees by their employers, detailing the coverage offered.

- Seek professional tax assistance if needed: If you’re unsure about how to handle Form 1095-B on your tax return or if you have complex tax situations, consider consulting a tax professional or using tax software for guidance.

Remember, the information on Form 1095-B helps verify your health coverage for the previous year and is used when filing your tax return. If you didn’t receive this form by the specified time, contact your insurance provider or the entity responsible for providing the form to ensure you have the necessary information for your tax filing.

>>>PRO TIPS: Federal Tax Credit for Residential Solar Energy

3. What Are the Benefits of Form 1095-B?

Form 1095-B is a tax form used to report information about minimum essential health coverage. Form 1095-B offers several important purposes related to health coverage and tax filing as it:

- Serve as your proof of Health Coverage: Form 1095-B provides evidence of minimum essential health coverage. This information is essential for IRS to verify that you and your dependents qualify for health coverage as required by the Affordable Care Act (ACA). It outlines the months during the previous year in which you were covered by a health insurance plan.

- Aids your Tax Reporting: While Form 1095-B is not filed with your tax return, it assists in the preparation of your tax returns. It helps you verify whether you and your dependents had health coverage for each month during the tax year. This information is necessary for reporting compliance with the individual mandate of the ACA and to determine eligibility for Premium Tax Credits or exemptions.

- Assists in you to avoid Penalties: The information provided on Form 1095-B helps you to avoid penalties related to not having minimum essential health coverage as required by the ACA. If you were covered for the entire year or qualified for exemptions, you generally won’t face penalties.

- Reports Information for IRS and Health Coverage Verification: Health insurance providers, government agencies, and employers that sponsor self-insured group health plans use Form 1095-B to report information to the IRS about individuals covered by their health plans. This aids the IRS in verifying health coverage and determining compliance with ACA regulations.

- Ensure proper Record-Keeping and Documentation: Ensure you retain Form 1095-B for records purpose. It serves as proof of health coverage and might be needed for reference, especially when there are inquiries or audits regarding health coverage during a specific tax year.

- Support for Healthcare-Related Decisions: Having a record of Form 1095-B can be useful when you need to review your healthcare history or when making decisions about future health coverage options.

Overall, Form 1095-B plays a crucial role in documenting and verifying health coverage, aiding in tax reporting, and ensuring compliance with the Affordable Care Act’s individual mandate.

4. How to Use Form 1095-B

To effectively use Form 1095-B, first, retain it for your personal records as it doesn’t need to be directly filed with your tax return but serves as important documentation. Verify the accuracy of the information provided, particularly confirming the months of coverage for yourself and any dependents. During tax filing, utilize the data from the form to confirm and report your health coverage accurately on your tax return.

Additionally, if you’re seeking exemptions from the individual mandate or applying for premium tax credits, the details on the form may be necessary. Should you detect any discrepancies or inaccuracies, promptly contact your insurance provider to rectify the information.

>>>GET SMARTER: Form 8917: What It Is, How to File It

Recap

Form 1095-B might seem like just another piece of paperwork, but it’s actually your ticket to understanding and verifying your health coverage journey. Remember, while you don’t file it with your taxes, this form holds crucial details about your and your dependents’ health insurance coverage throughout the year. Keeping it on hand for your records ensures you’ve got the proof needed if any questions pop up about your coverage.

Plus, knowing how to navigate this form not only helps with tax reporting but can also uncover potential benefits or exemptions you might qualify for. So, hold onto your Form 1095-B—it’s more than just a document; it’s your key to staying on top of your health insurance game!

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.