Form 1095-B is a vital document related to healthcare coverage that your employer may need to file. It’s specifically designed to inform you about the health insurance coverage provided throughout the year. Your company might need to file this form if it falls under specific criteria outlined by the IRS.

It serves as proof of your health coverage and it is used to determine whether you meet the Affordable Care Act’s individual mandate. If your company provides self-insured health coverage or is a small employer with a self-insured health plan, it’s likely required to furnish this form to the IRS and to you, the employee.

However, not all employers need to file Form 1095-B, as it depends on the size of the workforce and nature of the health coverage your employer offers. Understanding whether your company must file this form is essential as it helps you to accurately document your health coverage.

Form 1095-B: Does Your Company Need to File It?

- Form 1095-B Overview

- Employer Filing Criteria

- Self-Insured Plans

- Healthcare Coverage Proof

- Individual Mandate Compliance

- IRS Form 1094-B

- How to File as an Employer

- How to File as an Employee

Recap

1. Form 1095-B Overview

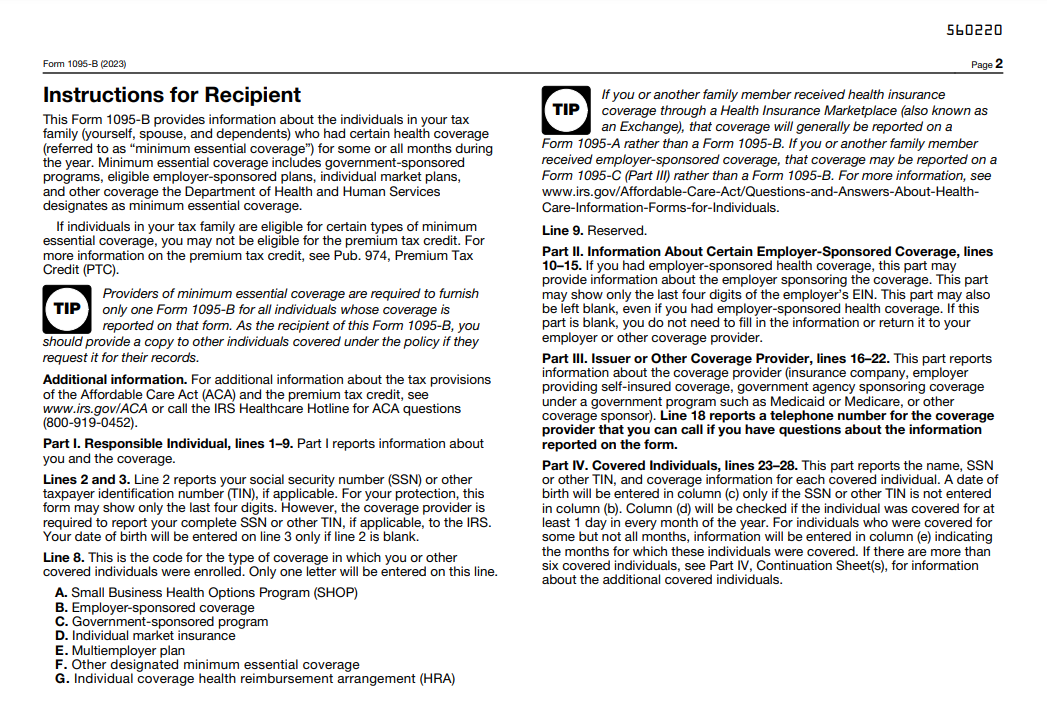

Form 1095-B is a vital document serving as proof of your health insurance coverage throughout the year. It’s issued by your employer, insurance company, or the government program that provides your health coverage. This form outlines who in your household was covered by the insurance plan and for which months.

You need it when filing your taxes to demonstrate compliance with the Affordable Care Act’s individual mandate, showing that you had minimum essential coverage. The form contains details about your insurance issuer, the individuals covered, and the duration of coverage during the year.

However, not everyone receives this form; it’s typically provided to you if you’re covered under certain health insurance plans, like employer-sponsored coverage or government-sponsored programs. Make sure you keep this document safe because it is important for tax purposes and maintaining a record of your healthcare coverage status.

2. Employer Filing Criteria

To determine if your employer needs to file Form 1095-B, several criteria must be met. Firstly, if your company provides self-insured health coverage, it’s required to furnish this form to you and the IRS. This includes employers who assume the financial risk for providing health care benefits to employees.

Secondly, your small employer with self-insured health plans also falls under the filing obligation. Typically, small employers are those with fewer than 50 full-time employees, including full-time equivalent employees. Larger employers, generally those with 50 or more full-time employees, often provide you with Form 1095-C instead, detailing health insurance coverage offered to you.

Additionally, businesses that provide you with health coverage through certain government programs like Medicaid and CHIP may need to issue Form 1095-B. However, if your employer offers you fully insured health plans, your company does not have to file this form; instead, insurance companies providing the coverage take on this responsibility.

3. Self-Insured Plans

A self-insured health plan means your employer takes on the financial risk of providing you with healthcare benefits. If your company offers you such coverage, it’s obliged to furnish Form 1095-B. In these plans, your employer directly pays for your healthcare expenses instead of paying fixed premiums to an insurance company.

This means your employer assumes the responsibility for the healthcare costs incurred by its employees. Form 1095-B is crucial in documenting this self-insured health coverage. It details the months you and your household were covered by this employer-sponsored plan.

If your employer offers you this type of coverage, the accurate and timely completion of Form 1095-B becomes essential to correctly reflect the health coverage provided under the self-insured plan.

>>>PRO TIPS: Form 1095-B: What It Is, How to File

4. Healthcare Coverage Proof

Form 1095-B serves as concrete proof of your healthcare coverage throughout the year. This document details the months you were covered by health insurance, listing everyone in your household covered by the plan. It’s essential for fulfilling your obligation under the Affordable Care Act to have minimum essential coverage.

When you file your taxes, this form demonstrates that you had qualifying health insurance. Don’t forget to keep this document safe so you can maintain a record of your healthcare coverage status. It solidifies your proof of having adequate health coverage as required by law.

5. Individual Mandate Compliance

The Individual Mandate, part of the Affordable Care Act, requires you to maintain minimum essential health coverage. Form 1095-B plays a pivotal role in demonstrating your compliance with this mandate.

It verifies that you’ve had continuous health coverage throughout the year, meeting the required standards set by the law. By having this form, you showcase your adherence to the Individual Mandate when filing your taxes. It’s crucial you ensure you possess the necessary health coverage for each month of the year, as indicated in the form.

If there are any gaps or discrepancies in your coverage, it might affect your compliance with this mandate. Make sure you stay informed about your coverage status as it helps you avoid potential penalties for non-compliance with the Individual Mandate.

6. IRS Form 1094-B

Form 1094-B is a summary transmittal form that complements Form 1095-B when your employer is reporting the health coverage of its employees to the IRS. While you and every other employee receive your respective Form 1095-B, Form 1094-B provides the IRS with an overall picture of the coverage offered by your employer or entity.

Think of it as a cover sheet summarizing the health coverage information. This form includes details about the filer, such as the name, address, and employer identification number (EIN). It also highlights the total number of individual Form 1095-Bs your employer submitted.

Form 1094-B is essential for employers, insurers, or entities responsible for offering health coverage to compile and summarize the individual coverage details for submission to the IRS. It acts as a way to consolidate and present the collective information about the health coverage provided to all covered individuals.

>>>GET SMARTER: LLC Taxes: Full Guide

7. How to File as an Employer

As an employer, you can file Form 1095-B using the steps below:

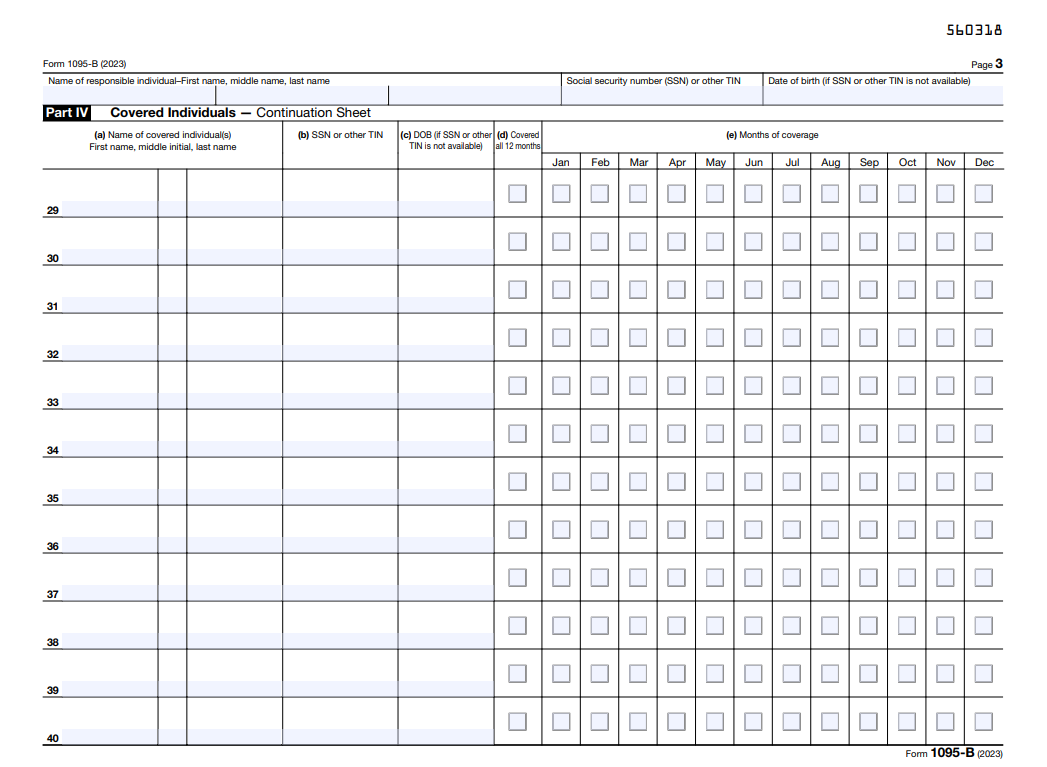

- Gather Information: Collect details on covered individuals, including names, Social Security numbers, and months of coverage.

- Acquire Forms: Obtain Form 1095-B templates either directly from the IRS or through a tax software provider.

- Estimate Forms Needed: Determine the number of forms you need based on the total number of covered employees.

- Complete Forms: Fill out each form accurately, ensuring you include all required information for each covered individual.

- Fill out Form 1094-B: Once Form 1095-Bs for all covered individuals are completed, fill out Form 1094-B correctly.

- Furnish Copies: Distribute copies of Form 1095-B to covered individuals by the IRS deadline, ensuring all employees receive the necessary documentation.

- File with IRS: Submit Form 1095-B for each covered individual along with the summary transmittal form, Form 1094-B, either electronically or by mail.

- Maintain Records: Keep copies of all forms filed for at least three years for record-keeping purposes.

8. How to File as an Employee

Here’s a detailed step by step process on how to file Form 1095-B as an employee:

- Receive Form: Await receipt of Form 1095-B from your employer, insurer, or government program providing your health coverage.

- Review Information: Check the form for accuracy, ensuring it lists you and any covered household members accurately for each month.

- Keep for Records: Retain the form for tax filing purposes, maintaining it with your tax records for future reference.

- Use for Taxes: Use the information from your Form 1095-B when filling out your tax return to indicate your health coverage throughout the year.

- Submit to the IRS: Submit your tax return to the IRS either electronically or via mail. Make sure you include any necessary information about your health coverage from Form 1095-B to ensure compliance.

Recap

Form 1095-B is crucial for documenting health coverage throughout the year. If your company provides you with certain health plans, like self-insured coverage, your employer must file this form. It proves your compliance with healthcare requirements and serves as vital proof of your coverage for tax purposes.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.