The answer is yes, you can convert your LLC to an S-corp when filing your tax return. But there are some requirements and implications that you need to consider. If you start your business as a limited liability company (LLC), you’re likely going to wonder if you can convert your LLC to an S-corporation (S-corp) when filing your tax returns. Converting an LLC to an S-corp is not a change in the legal structure of your business, but a change in the tax classification.

This means that your LLC business still enjoys the benefits of liability protection and flexibility, but it’s also subject to the rules and regulations of an S-corp. The main reason why you can consider switching to an S-corp is to save on self-employment taxes, which only apply to all the profits of your LLC venture. However, an S-corp needs to also pay the business shareholders a reasonable salary, which is subject to payroll taxes. Therefore, you need to do careful analysis of the costs and benefits, as well as the eligibility criteria and the filing process before deciding to convert an LLC to an S-corp.

Can I Convert My LLC to an S-Corp When Filing My Tax Return?

- Choose an Eligible Entity

- File Form 2553

- Meet Requirements

- Adopt S-corp Structure

- Issue Stock Certificates

- Maintain S-corp Compliance

- Update Payroll and Taxes

- Report Income and Deductions

- Complete Annual Filings, Including Schedule K-1.

1. Choose an Eligible Entity

To convert an LLC to an S-corp when filing your tax return, choose an eligible entity. Ensure that the LLC meets the Internal Revenue Service’s (IRS) criteria for S-corp eligibility. Specifically, the LLC must be a domestic entity, have only allowable shareholders (individuals, certain trusts, and estates), maintain no more than 100 shareholders, and consist of only eligible individuals or entities. Furthermore, all shareholders must consent to the S-corp election. By carefully verifying that the LLC aligns with these requirements, you establish the foundation for a successful conversion to S-corp status, allowing for favorable tax treatment while meeting the regulatory standards set by the IRS.

2. File Form 2553

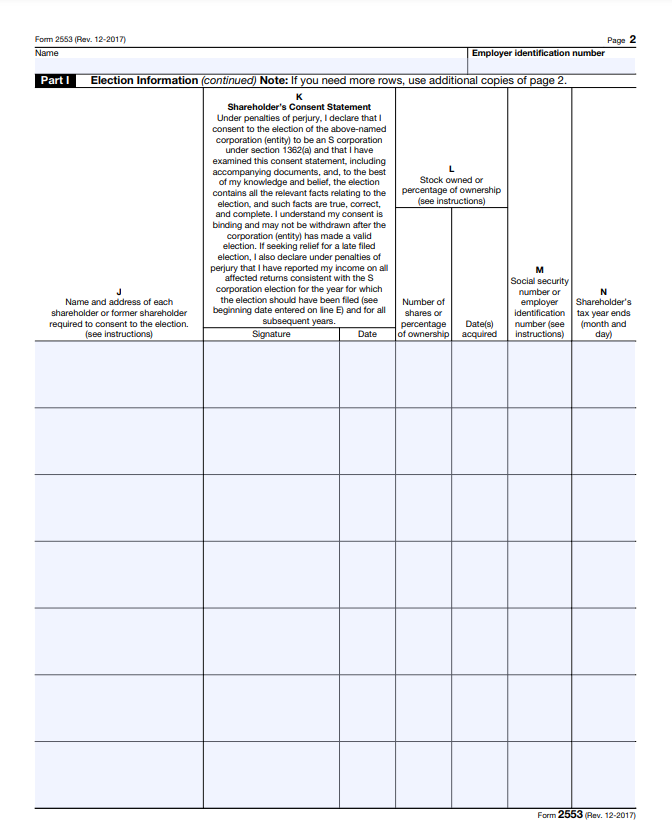

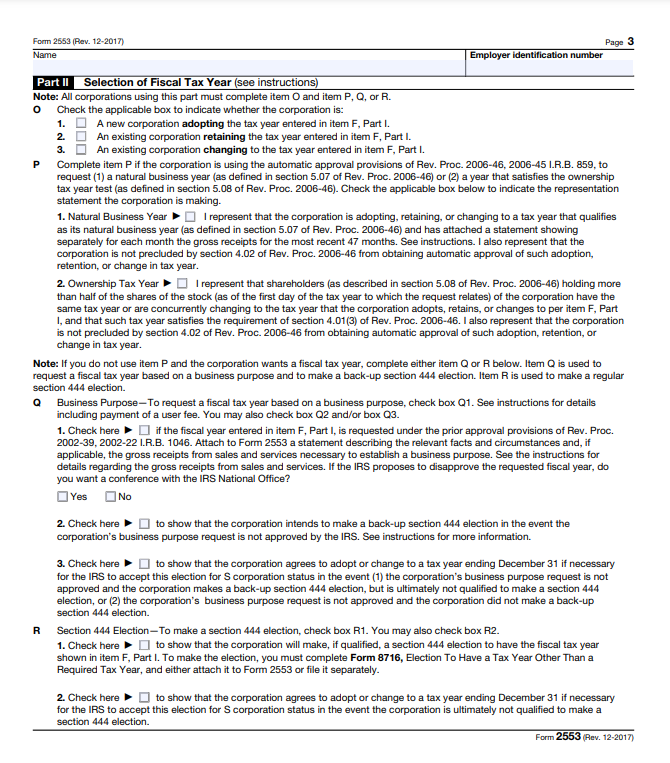

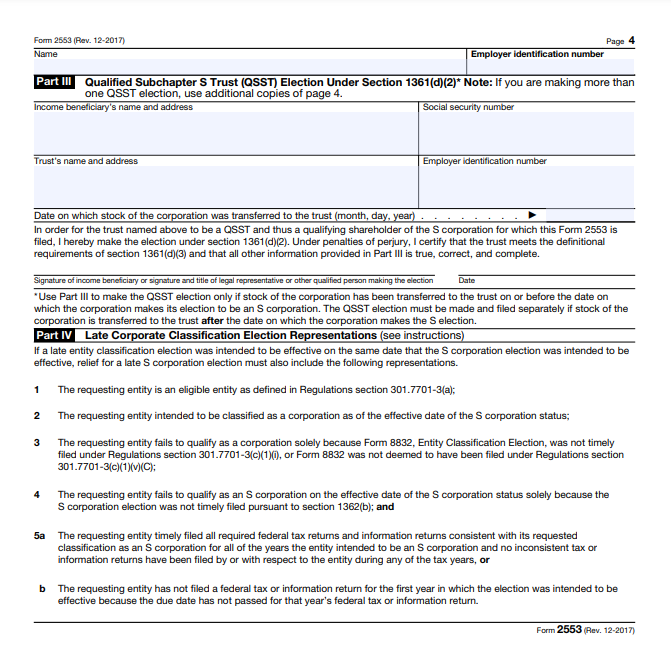

To easily convert an LLC to an S-corp when filing your tax return, file Form 2553. Complete and submit Form 2553 to the Internal Revenue Service (IRS). This form is an election for S-corporation status and is crucial for the transition. When filing Form 2553, provide essential details about your LLC, including its name, address, Employer Identification Number (EIN), and the date you wish the S-corp status to be effective. See to it that all members or shareholders sign the form. The deadline for filing Form 2553 is generally within two months and 15 days from the beginning of the tax year in which you want the S-corp election to take effect. The IRS can still accept Late submissions under certain conditions. Ensure that you carefully follow the instructions the IRS provides for accurate completion and timely submission of Form 2553.

3. Meet Requirements

To seamlessly change an LLC to an S-corp when filing your tax return, meet the requirements. Make sure the shareholders are U.S. residents or citizens, and the LLC has only one class of stock. Meeting these requirements ensures that the entity aligns with the characteristics the Internal Revenue Service (IRS) mandates for S-corporations, paving the way for a smooth transition in the tax filing process and the ongoing compliance with S-corp regulations.

>>>PRO TIPS: Charitable Contributions: Everything You Must Know

4. Adopt S-corp Structure

To change an LLC to an S-corp when filing your tax return, adopt the S-corp structure. Restructure the internal operations of the LLC to align with S-corporation requirements. This includes instituting a formal corporate structure with designated officers (such as a president, treasurer, and secretary), establishing a board of directors if applicable, and adhering to corporate governance protocols. Additionally, the S-corp structure requires maintaining detailed records of meetings, decisions, and resolutions, reflecting a more structured and organized approach compared to the typical flexibility of an LLC. This step is crucial for the IRS to recognize your entity as an S-corp for tax purposes and ensures compliance with the specific regulations governing S-corporations.

5. Issue Stock Certificates

To completely convert an LLC to an S-corp when filing your tax return, issue stock certificates. Do allocation of shares to individual members of the LLC who are becoming shareholders in the newly formed S-corp. Stock certificates serve as tangible evidence of ownership and typically contain essential details such as the shareholder’s name, the number of shares you issue, and the company’s name. This step is crucial for establishing the corporate structure necessary by S-corp status, as it reflects the transition from the membership interests characteristic of an LLC to the share-based ownership structure typical of a corporation. Proper documentation and record-keeping are essential to ensure compliance with S-corp regulations and to provide clarity regarding ownership stakes within the converted entity.

6. Maintain S-corp Compliance

To quickly convert an LLC to an S-corp when filing your tax return, maintain an S-corp compliance. Adhere to the operational and regulatory standards set for S-corporations. Conduct regular shareholder meetings, keep accurate corporate records, and ensure that the company’s financial structure aligns with S-corp guidelines. Additionally, it necessitates proper documentation of significant business decisions and the avoidance of any actions that can jeopardize the S-corp status. To stay compliant, your business must continue following IRS regulations for S-corps, fulfill annual filing requirements, and provide shareholders with timely and accurate information through the distribution of Schedule K-1 forms, which outline their respective share of income, deductions, and credits.

>>>GET SMARTER: Business Tax Cheat Sheet on IRS Forms, Schedules and Resources

7. Update Payroll and Taxes

To convert an LLC to an S-corp when filing your tax return, update payroll and taxes. Establish a formal payroll system and ensure that shareholders receive reasonable salaries. Unlike LLCs, S-corps require you to pay active shareholder-employees a fair market value salary, subject to payroll taxes. This means determining appropriate compensation based on industry standards and individual roles within the company. Additionally, the S-corp structure necessitates compliance with payroll tax obligations, including Social Security and Medicare taxes. Set up a payroll system, withhold taxes, and file relevant payroll tax forms. Adhering to these payroll and tax obligations is crucial for maintaining S-corp status and avoiding potential IRS scrutiny.

8. Report Income and Deductions

To conveniently change an LLC to an S-corp when filing your tax return, report income and deductions. File Form 1120-S—an S-corporation form that serves to detail your company’s income, deductions, and credits. Shareholders then receive a Schedule K-1, outlining their share of the corporation’s income, losses, and deductions, which they incorporate into their individual tax returns. Do well to accurately document all sources of income, legitimate business expenses, and deductions to ensure compliance with tax regulations. This reporting mechanism allows for the appropriate allocation of profits and losses among shareholders and plays a vital role in the overall tax efficiency of the S-corp structure.

9. Complete Annual Filings, Including Schedule K-1

To convert an LLC to an S-corp when filing your tax return, complete annual filings, including schedule K-1. Remember that to complete annual filings, including Schedule K-1, you must file Form 1120S, the U.S. Income Tax Return for an S Corporation. This form reports the S-corp’s income, deductions, and credits. Additionally, Schedule K-1, a supplementary document that you provide each shareholder, outlining their share of the corporation’s income, losses, deductions, and credits. It’s important for shareholders to receive this information, as they are going to report it on their individual tax returns.

Recap

To convert an LLC to an S-corp during tax filing, start by confirming the LLC’s eligibility, then submit Form 2553 to elect S-corp status. Ensure the entity meets S-corp requirements and adjusts its operational structure accordingly. Issue stock certificates to shareholders and maintain ongoing S-corp compliance.

Establish and update payroll, ensuring reasonable salaries, and file necessary taxes. Report income, deductions, and credits by filing Form 1120S, and don’t forget the important step of completing annual filings, including the distribution of Schedule K-1 to shareholders. These meticulous actions collectively facilitate a seamless transition and adherence to S-corp regulations throughout the tax filing process.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. . For comprehensive tax, legal or financial advice, always contact a qualified professional in your area. S’witty Kiwi assumes no liability for actions taken in reliance upon the information contained herein.

No Comment! Be the first one.