Our Verdict

Check out Best Egg if you prefer an online lender with a competitive rate and diversification of personal lending options. Founded on March 12, 2014, Best Egg claims to have a projected loan amount of $21 billion out of which it has so far lent out $1.1 million.

Choose this lender if you are a borrower who wants unsecured or secured personal loans with a relatively low amount, not more than $50,000.

However, know that the Best Egg minimum loan amount varies by state even though the lowest you can get is $2,000. For instance, expect a minimum of $6,500 loan amount if you reside in Massachusetts. Don’t anticipate an amount lower than $5,000 and $3,000 if you are a resident of Ohio, New Mexico, and Oregon, respectively.

Be aware that—despite being an online lending company—you can’t get Best Egg’s personal loan products If you reside outside the United States.

Visit the below address and website for more information.

Best Egg Loan Agency

Headquarters

3419 Silverside Rd, Wilmington, DE 19810, United States

Phone number: 1-855-282-6353

Mail: PO Box 42912

Philadelphia PA, 19101

Email address: [email protected]

Pros

- Soft pull on your credit score

- Discount rate on home improvement loan

- Variation in loan products

- Fixed-rate on all loan types

- Quick funding

- Motivation for borrowers expecting the low amount

- Online accessibility

- Calculator for a personal loan

Cons

- Home improvement loan exclusive to homeowners

- Limited state availability

- Impossibility of in-person approval

- Restrictions in funding amount

- Shortness in loan terms

- Absence of specification in rate, terms, and amount

- Variation in loan cost by states

- Existence of origination fees

Who This Product Is Best For

Explore Best Egg if you are a borrower who:

- Seeks lender with a digital presence

- Wants a modest loan sum

- Lives in the United States or regions where Best Egg covers

- Has a required credit score and looks for a lender with a soft pull on credit scores.

- Prefers a loan agency that offers fast disbursement of loan cash (within 24 hours of application).

- Desires a variety of personal loans with friendly rates and fees.

- Wants lender with an exclusive offer on personal financing for a home upgrade.

Who This Product Isn't Right For

Avoid this product if you are a borrower who:

- Loves to have a face-to-face agreement.

- Seeks a lender that offers higher loan cash than Best Egg.

- Doesn’t live in the region where Best Egg’s service covers.

- Has a credit score below half of 600s.

- Desires specification in rates and fees.

- Hates paying origination fees.

- Loves to do business with much older lenders.

What This Product Offers

Debt Consolidation: Choose this loan if you are looking to merge all your debts into one single entity and thereby lowering high interest on your debt payments.

Credit Card Refinancing: Take out this loan to combine the debts on your credit cards into single debts and start paying the debt at a fixed rate throughout its expiration.

Understand that credit card financing and debt consolidation are very similar and they tend to achieve the same aim.

Home Improvements: Want to give your house an exquisite appearance? Consider a home improvement loan to buy home tools, renovate your home, and pay home utility bills. However, you can only qualify for this loan if you are a house owner.

Moving Expenses: Move comfortably into your new apartment with ‘moving expenses’ because this loan can take care of your moving costs—like paying the movers and hiring a packing truck.

Major Purchases: Address your miscellaneous needs with Best Egg’s major purchases loan. Get this loan to handle emergencies like fixing your faulty car and leaking roof including unexpected fines and bills.

Baby & Adoption: Settle for this loan to get financial support tailored for baby delivery and adoption. Pay fees, expenses for medical care, or adoption legal costs swiftly.

Special Occasion: Thinking of the cost to celebrate your wedding party, birthday party, family reunion, or any personal anniversary? Get Best Egg’s special occasion loan (as ever available financing option) to fund any of your happenings without thinking of the cost.

Vacation Loans: Make a trip to that your dream place for vacation (to whine off stress and spend nice moments with your spouse, friends, or family) without minding the cost.

Take care of the expenses like transportation, lodging, feeding, and other services with Best Egg’s vacation loan.

Secured Personal Loan: Get this loan to tackle any challenges at a very low rate. With a secured personal loan, expect a loan type that looks like home equity. However, don’t expect your house to serve as collateral; rather, the items in your house play the collateral role.

Product Details

Debt Consolidation

Make your debts one and start paying it down at a fixed rate to reduce your financial burden.

Expect a loan amount from $2,000 to $50,000 when you apply for this loan. You can anticipate a repayment term ranging from 36 to 60 months with an annual rate between 8.99% and 35.99%. In addition, beware that you are to pay an origination fee which can reach 8.99%.

Though no specification on repayment terms, prepare for a monthly payment between $81 to $84 (assuming you want to borrow $2,000 with a repayment term of 36 months and a credit score of not more than 599).

Credit Card Refinancing

Consolidate the debts on your credit card to easily pay them down on a single card with a lower interest rate and a better payment condition.

Ready for a loan fund that begins at $2,000 and reaches up to $50,000 including an expiration term that is between 36 to 60 months. Best Egg maintains an annual rate from 8.99% to 35.99%. Get set for an origination that can be up to 8.99% of your principal amount.

For instance, expect a monthly payment of $204 to 239 for a credit card refinancing amount of $6000 with an expiration period of 3 years (provided that you have a FICO score of 670+).

Home Improvements

Transform your house into a Palace by getting this home improvement loan to finance your home’s upgrading, renovation, and home equipment.

Look forward to an amount that starts from $2,000 to $50,000 in addition to a fixed APR which ranges from 8.99% to 35.99%. You can enjoy a repayment period that’s between 5 and 7 years.

In addition, watch out for a 20% discount rate when you take out a home improvement loan as a house owner.

Moving Expenses

Get fast cash to fund your moving expenses when you consider Best Egg’s moving loan. You can take out a minimum amount of $2,000 and a maximum of $50,000.

Be expecting a fixed rate of 8.99% up to 35.99% and a repayment term that ranges from 36 months to 60 months.

Watch out for an origination fee that can reach up to 8.99% of the total loan amount.

Major Purchases

Buy conveniently at your grocery store, repair your car, or deal with any impromptu financial situation with Best Egg’s major purchases loan.

To get this loan, anticipate an amount from $2,000 to $50,000 packing with a repayment that can be as short as 3 years, and as long as 5 years. With this loan, you can be salivating at a competitive rate that ranges from 8.99% to 35.99%.

However, depending on your qualification, be ready for an origination fee that can go as high as 8.99%.

Baby & Adoption

Thinking of bringing a new baby into your home or your family is awaiting the arrival of a newborn? Be rest assured that this loan is exactly what you need.

Like most of this lender’s personal financing products, expect a fixed amount that ranges from $2,000 to $50,000 and an expiration of 3 to 5 years.

Ready to pay a friendly annual rate of 8.99% to 35.99%.

Nevertheless, gird up your loins for an origination fee of 8.99%.

Special Occasion

Take time out to enjoy memorable moments with your friends, family, or siblings. Count on this loan to handle expenses like feeding, transportation, and lodging.

Know that an amount that starts from $2,000 to $50,000 awaits you upon securing approval. You have a repayment term that has a minimum of 36 months and a maximum of 60 months. Also, Best Egg greets you with a favorable interest rate that begins from 8.99% to 35.99%.

If approved, you are to pay an origination fee that can be up to 8.99% of your available fund.

Vacation Loans

Do you want a loan to fund your next vacation trip? Here is the product that Best Egg designed for you to take your stress away.

Secure approval for this loan and get a fund of not less than $2,000 and can reach up to $50,000. You have a minimum of 3 years and a maximum of 5 years to repay the loan. Enjoy a competitive rate that starts from 8.99% to 35.99%.

Upon approval, note that an amount worth 8.99% may be removed as an origination fee.

Secured Personal Loan

Use the item in your home as collateral to get this loan. Because this loan is a secured loan, await the arrival of a 20% discount on your annual rate.

You can have loan cash as low as $2,000 and as high as $50,000 with a promising repayment term that begins from 5 years and can reach up to 7 years.

Note that 8.99% of your lending amount serves as an origination fee. Also, be aware that this loan is not a home equity loan, you can use it for general purposes and it doesn’t require your full home as collateral (only the items in your house).

Where This Product Stands Out

Diversification in lending options

Have access to choose from a pool of financing products for personal needs. With Best Egg, meet your financial wants by selecting a suitable personal loan for yourself—from debt consolidation, credit card financing, to home improvement, moving expenses including vacation loans, and secured personal loans.

Accessibility to immediate cash

Be rest assured that you can receive your funds in your account within 24 hours of getting loan approval.

Competitiveness in APR

Take the advantage of the favorable APR which is fixed throughout the loan span. Best Egg offers you a fixed rate as low as 8.99% which you have to be paying monthly.

Digital services

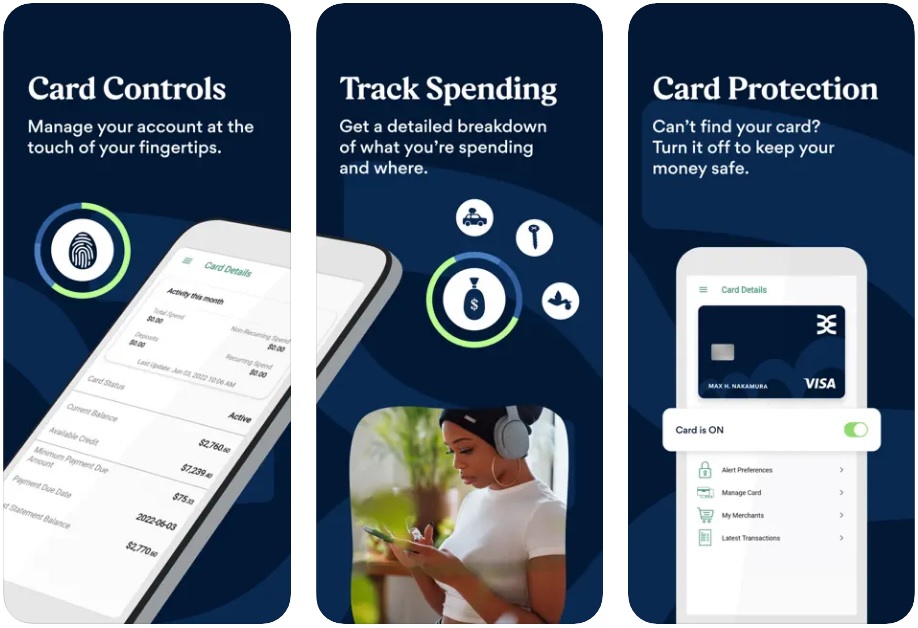

Apply for any loan of your choice online and enjoy a fast application process with quick approval on Best Egg’s web platform. Don’t forget that Best Egg itself is an online lender with much digital presence.

Promotions and discounts to homeowners

Apply for Best Egg’s secured personal loan or home improvement to enjoy a 20% discount on interest and a longer repayment term that is up to 7 years.

Availability in many regions

Do you prefer a lender with a presence in different regions and states? Place your bet on Best Egg because you can enjoy its service from different places within the United States including Massachusetts, Oregon, and Washington DC.

Purpose-specific personal loans

Tap into different personal loans tailored for different situations on Best Egg. Improve your home, consolidate your debts, and visit your dream places—with home improvement loans, debt consolidation or credit card refinancing, and vacation loans, respectively.

Consideration for poor credit score

Consider this lender to get a personal loan even with a credit score that can be as low as 599. Notwithstanding, prepare to pay higher charges on interest and origination.

Where This Product Falls Short

Limited funding channels

Don’t expect multiple funding options as Best Egg is an online lender who partners with Blue Ridge Bank and Cross River Bank for cash disbursement.

Origination fee

Ready to pay an origination fee which is almost 10% of the total amount you are taking out.

Absence of manual application

Don’t choose this lender if you prefer an in-person agreement on a loan. Considering a local bank like KeyBank, Fifth Third Bank, and Wells Fargo can be a better option for you.

Shortened period for repayment

Seek elsewhere for personal financing if you are looking for a loan term that is not less than a decade. With Best Egg, you can only get a loan period of 5 years while it can be 7 years if you are a homeowner.

Exclusivity in rewards and discounts

Don’t expect any rewards or discounts if you don’t own a house. Best Egg promotional service is only available for homeowners.

Low funding amount

Consider other alternatives if you want a personal loan price that is higher than $50,000. You can only get a loan of not more than $50,000 with this lender.

Limitation of personal financing for general needs

Check on other lenders if you want multiple financing products that serve a general purpose. Best Egg offers you tailored products which are purpose-specific— that is, you may have to find another lender if your need is not available on Best Egg’s list.

Favorability in rate for borrowers with higher credit score

Prepare for higher rates if you are a borrower with poor credit.

How to Qualify for This Product

You can conveniently qualify for Best Egg Personal loans if you have the required requirements which are:

- A credit score of 640+

- Debt-to-income ratio

- Proof of citizenship

- Annual revenue

- Proof of home ownership (for home improvement and secured personal loans)

Call the lender’s number to learn more about the qualifications requirements. Nevertheless, having the above documents can put you in a good place not far from approval.

How to Apply for This Product

Sign up with your email on the Best Egg website to confirm the personal loan you qualify for. Visit the lender’s website and click on “check my offer”.

Fill in your personal information and choose your region, then enter your needed amount. Best Egg carries out a soft pull on your credit history to determine which loan you may apply for.

Whatever the case may be, take the following steps to apply for Best Egg’s personal loan products

- Visit the Best Egg website

- Enter your personal email address

- Fill in your personal information (age, region, and employment status)

- Provide your income revenue (both salary and annual income)

- Expected loan amount

- Loan purpose

- And submit the application

After this, submit the form and wait for Best Egg to inform you whether you qualify for any of its loans or not.

Alternative to This Product

SoFi

Consider SoFi if you prefer a lender that offers a higher loan amount than Best Egg. SoFi gives a variety of personal loan products with an amount that ranges from $5,000 to $100,000. Also, enjoy a competitive interest rate from 8.99% – 23.43% relatively lower than Best Egg whose rate can reach 35.99%.

LightStream

Focus on LightStream if you are looking for a lender with the best rate. Get a loan price as high as $100,000 with a favorable interest as low as 5.99%.

Customer Reviews

On the Better Business Bureau platform, Best Egg enjoys an A+ rating with an eye-watering review rating of 4.87 stars out of possible 5 stars. Best Egg has closed 262 complaints with the bureau in the past four years and also earned its star rating from 2,154 customer reviews. In addition, Best Egg has 4.6 stars on TrustPilot based on 5,575 customer reviews.

Methodology

We reviewed *this product* based on 20 data points in the categories of loan details, loan costs, eligibility and accessibility, customer experience and the application process. We rated *this product* based on the weighting assigned to each category:

- Loan cost: 35%

- Loan details: 25%

- Customer experience: 20%

- Eligibility and accessibility: 10%

- Application process: 10%

Within each major category, we also considered several characteristics, including available loan amounts, repayment terms and applicable fees. We also looked at minimum credit scores and time in business requirements and the geographic availability of the lender. Finally, we evaluated *this product* customer support tools, borrower perks and features that simplify the borrowing process—like online applications, prequalification options and mobile apps.

No Comment! Be the first one.