Are you looking for a business credit card that can help you manage your expenses, earn rewards, and enjoy benefits? If so, consider the cards that the American Heritage Credit Union offers. This is a financial cooperative that serves its members with quality products and services. American Heritage Credit Union has two types of business credit cards: Business Cash Reward Mastercard® and Business Low Rate Mastercard®. With these two business credit cards, you have everything at the tip of your finger to take your business to the next level. Do you want to learn how to choose the best one for yourself? If yes, continue reading the article before you get the secret packages that each card offers. Are you ready? Let’s dive in now!

- Business Cash Reward Mastercard®

- Business Low Rate Mastercard®

Overview of the Best American Heritage Business Credit Cards

How to Choose the Best American Heritage Business Credit Cards

Pros & Cons of Best American Heritage Business Credit Cards

What to Watch Out For

Pro Tips

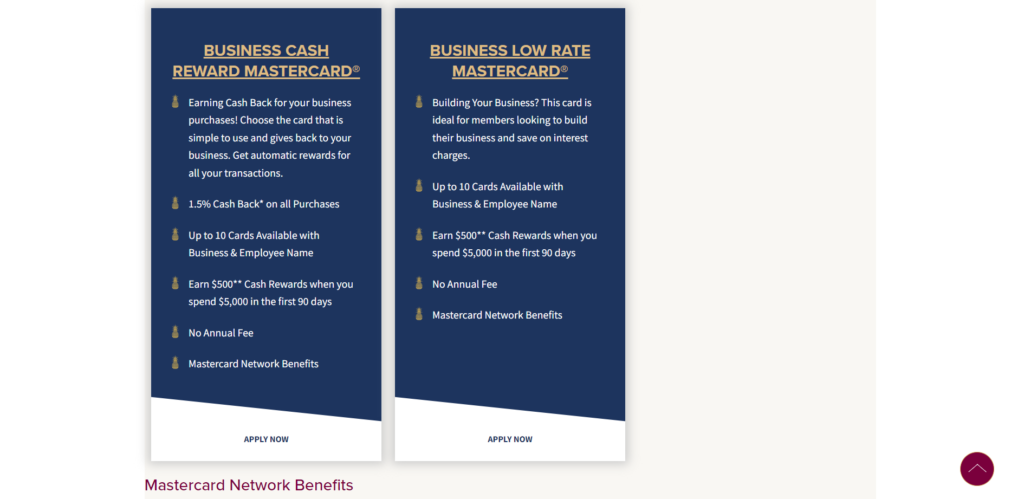

1. Business Cash Reward Mastercard®

Know that this card is ideal for you if you want to earn cash back on every purchase you make in your business. You can also get a generous welcome bonus and no annual fee.

Pros

- Earn unlimited 1.5% cash back on all your business purchases

- Earn $500 cash rewards when you spend $5,000 in the first 90 days

- Don’t worry about the annual fee

- Enjoy Mastercard network benefits, such as travel insurance, concierge service, price protection, and identity theft resolution

- Receive up to 10 cards available for your business and employees’ names

Cons

- Don’t think of getting an introductory 0% APR on purchases or balance transfers

- Expect variable APR of 18.24% – 24.24%. Your creditworthiness decides what rate you get

- Expect a foreign transaction fee of 3% of each transaction outside the U.S

- Expect a deduction of cash advance fee of either $10 or 4% of the amount of each transaction (whichever is greater)

- Charges late payment fee of up to $39

- Ready to be a member of American Heritage Credit Union to apply for this card

- Apply online, by phone, or at a local branch

- Provide your business name, address, phone number, tax identification number, annual revenue, and monthly expenses

- Provide your name, address, phone number, social security number, date of birth, income, and housing information

- Redeem your cash rewards as a statement credit or a deposit into your American Heritage account

2. Business Low Rate Mastercard®

Give this card a try if you are a business owner who wants to save on interest charges and enjoys a low rate. In addition, you can benefit from its exclusive offers such as; a welcome bonus and no annual fee.

Pros

- Earn $500 cash rewards when you spend $5,000 in the first 90 days

- Enjoy cards with no annual fee

- Enjoy Mastercard network benefits, which include travel insurance, concierge service, and price protection

- Access up to 10 credit cards for your business and employees

- Get a lower variable APR of 14.24% – 20.24%

Cons

- Don’t expect cash back or other rewards on purchases

- Don’t expect an introductory 0% APR offer on purchases or balance transfers

- Prepare for a foreign transaction fee of 3% of each transaction in U.S. dollars

- Ready for a cash advance fee of either $10 or 4% of the amount of each transaction

- Pay a late payment fee of up to $39

- Be a member of American Heritage Credit Union to apply for this card

- Apply online, by phone, or at a local branch

- Provide your business name, address, phone number, tax identification number, annual revenue, and monthly expenses

- Provide your name, address, phone number, social security number, date of birth, income, and housing information

- Allows you to pay your balance in full each month or carry a balance with a low interest rate

Overview of the Best American Heritage Business Credit Cards

Understand that American Heritage Credit Union is a financial cooperative that comes into existence in 1948.

You can access the American Heritage Credit Union in two states: Pennsylvania and New Jersey. This financial institution has 40+ branches and over 5,300 shared branches across the country. You can also use its over 30,000 surcharge-free ATMs nationwide.

Bear in mind that it solely offers Mastercard which puts you in front to be a Mastercard holder and enjoy Mastercard benefits such as:

- Travel insurance: With up to $1 million, you can get coverage for trip cancellation, trip interruption, baggage delay, lost or damaged luggage, travel accident, and rental car collision or damage.

- Concierge service: You can get personalized assistance for travel planning, dining reservations, entertainment bookings, gift arrangements, and more.

- Price protection: You can receive reimbursement for the difference if you find a lower price for an eligible item you buy with your card within 60 days of purchase.

- Identity theft resolution: You can get assistance in case someone compromises your identity or steals your card.

- Mastercard Easy Savings®: You can get automatic rebates at participating merchants, such as gas stations, restaurants, hotels, and car rentals.

Other benefits include emergency card replacement, emergency cash advance, and Mastercard zero liability policy.

To be a business member of American Heritage, meet one of the following criteria:

- Work for one of the credit union’s partner companies or organizations, which include over 800 employers, associations, and communities in Pennsylvania and New Jersey.

- Live, work, or attend school in one of the credit union’s select geographic areas, which include Philadelphia, Bucks County, Montgomery County, parts of Delaware County in Pennsylvania, and parts of Burlington County and Camden County in New Jersey.

- Join the American Heritage Foundation with a one-time donation of $15.

- Have a relationship with an existing member of the credit union by blood, marriage, or adoption.

Do you want to join this credit union? If yes, you can apply online, by phone, or at one of its 40+ branches. You can also learn more about the credit union’s business credit cards and its values on its website.

How to Choose the Best American Heritage Business Credit Cards

Follow these steps to choose the best business credit card from American Heritage Credit Union:

- Determine your business needs and goals. Do you want to earn cash back on your purchases, or save on interest charges? How much do you spend on your business expenses each month? How often do you pay off your balance in full?

- Compare the features and benefits of the two business credit cards that American Heritage offers (Business Cash Reward Mastercard® and Business Low Rate Mastercard®). Both cards have no annual fee and offer a $500 cash reward when you spend $5,000 in the first 90 days. The Business Cash Reward Mastercard® also gives you 1.5% cash back on all purchases, while the Business Low Rate Mastercard® has a lower variable APR of 14.24% – 20.24%, depending on your creditworthiness.

- Consider the pros and cons of each card based on your spending habits and preferences. For example, if you are a transactor who pays your balance in full every month, you may benefit more from the cash back rewards of the Business Cash Reward Mastercard®. If you are a revolver who carries a balance from month to month, you may save more on interest charges with the Business Low Rate Mastercard®.

- Apply for the card that suits your business best. You can apply online, by phone, or at a local branch. You may need to provide your business name, address, phone number, tax identification number, annual revenue, and monthly expenses. You may also have to provide your name, address, phone number, social security number, date of birth, income, and housing information.

- Use your card responsibly and enjoy the rewards. Make sure to pay at least the minimum payment on time every month to avoid late fees and maintain a good credit score. You can also take advantage of the Mastercard network benefits, such as travel insurance, concierge service, price protection, and identity theft resolution.

Pros & Cons of Best American Heritage Business Credit Cards

- Pros

- Earn a $500 cash reward when you spend $5,000 in the first 90 days with either card

- Enjoy no annual fee with either card, which can save you money and make it easier to manage your expenses

- Get access to the Mastercard network benefits such as travel insurance, concierge service, price protection, and identity theft resolution, which can add value and security to your business transactions

- Get up to 10 cards for your business and employee

- Receive help to track and control your spending

- Choose between a cash back or a low-rate card, depending on your business needs and preferences.

- Cons

- Requires you to be a member of American Heritage Credit Union to apply for either card, which may limit your eligibility and options

- Requires you to live in Pennsylvania or New Jersey

- Don’t expect an introductory 0% APR offer on purchases or balance transfers with either card, which may make it harder for you to finance large expenses or pay off existing debt

- Ready to pay a foreign transaction fee of 3% of each transaction in U.S. dollars with either card, which may increase your costs when you travel or do business abroad

- Know that you have to pay a cash advance fee of either $10 or 4% of the amount of each transaction, whichever is greater, with either card, which may discourage you from using your card for cash needs.

- Has a late payment fee of up to $39 with either card, which may penalize you if you miss a payment deadline

What to Watch Out For

Here are the things you need to watch out for when choosing American Heritage business credit cards.

- Check the eligibility requirements

- Check the interest rates and fees

- Consider the rewards and benefits of each card

- Evaluate your liability

Pro Tips

- Know your business needs and goals.

- Compare the features and benefits of the two business credit cards.

- Consider the pros and cons of each card based on your spending habits and preferences.

- Apply for the card that suits your business best.

- Use your card responsibly and enjoy the rewards.

Recap

In conclusion, understand that American Heritage Credit Union is a financial cooperative that offers two types of business credit cards: Business Cash Reward Mastercard® and Business Low Rate Mastercard®. Both cards have no annual fee and offer a $500 cash reward when you spend $5,000 in the first 90 days. You can also access Mastercard network benefits. You can get up to 10 cards with your business and employee name.

Business Cash Reward Mastercard® lets you earn unlimited 1.5% cash back on all purchases. It has a variable APR of 18.24% – 24.24%, depending on your creditworthiness. It does not offer an introductory 0% on purchases or balance transfers.

On the other hand, with the Business Low Rate Mastercard®, you can save on interest charges with a low variable APR of 14.24% – 20.24%. However, you may not get any other rewards besides the welcome bonus. It also does not offer an introductory 0% APR offer on purchases or balance transfers.

To apply for either card, you need to be a member of American Heritage Credit Union and provide your business and personal information. You can apply online, by phone, or at a local branch.

No Comment! Be the first one.