Bank of America is one of the largest financial institutions in the United States, offering a wide range of banking and lending products, including home loans. As a major player in the mortgage industry, Bank of America provides various mortgage options for homebuyers and homeowners looking to refinance. However, before you rush to apply for a Bank of America home loan, it’s crucial to understand the intricacies of its offerings, pricing, and potential pitfalls.

Let’s Cut To The Chase!

Apply For It If:

- You’re an Existing Bank of America Customer: Leverage your integration into Bank of America’s ecosystem to benefit from their Preferred Rewards program, which offers rate discounts and reduced fees.

- You’re a Medical Professional: Take advantage of Bank of America’s Doctor Loan program, which offers unique benefits like flexible debt-to-income ratios and down payment requirements.

- You Value In-Person Banking: Enjoy the vast network of Bank of America branches for face-to-face interactions that online lenders can’t match.

- You’re Seeking Down Payment Assistance: Benefit from Bank of America’s grant programs for down payment and closing cost assistance to make homeownership more attainable.

- You Desire Integrated Banking Services: Simplify your financial management by keeping all your services with Bank of America’s comprehensive offerings.

>>>MORE: Logix Credit Union Review

DON'T BUY IF

- You’re a Rate-Sensitive Borrower: Look elsewhere for lower interest rates, as Bank of America’s rates tend to be higher than the industry average.

- You Seek Personalized Service: Consider smaller lenders or mortgage specialists if you value a more tailored approach, as Bank of America may not provide the level of personalized attention you need.

- You Need Specialized Loan Products: Find another lender if you require USDA loans or other niche mortgage products that Bank of America doesn’t offer.

- You priotize Fast Closing: Opt for online lenders specializing in quick closings if time is of the essence, as Bank of America’s processing times may be longer.

- You Prefer Minimal Cross-Selling: Choose a lender that focuses solely on your mortgage needs if you find Bank of America’s additional product offerings off-putting.

The Bottomline

Bank of America offers a solid range of mortgage products with competitive rates, especially for existing customers. However, its offerings may not suit everyone, particularly if you’re seeking specialized loans or the absolute lowest rates in the market. The bank’s size and reputation provide stability, but also come with potential drawbacks in terms of personalized service and flexibility.

Now, Let’s Detail Things For You

Bank of America’s mortgage offerings include conventional loans with both fixed-rate and adjustable-rate mortgages (ARMs), FHA loans, VA loans, jumbo loans, home equity lines of credit (HELOCs), and refinancing options.

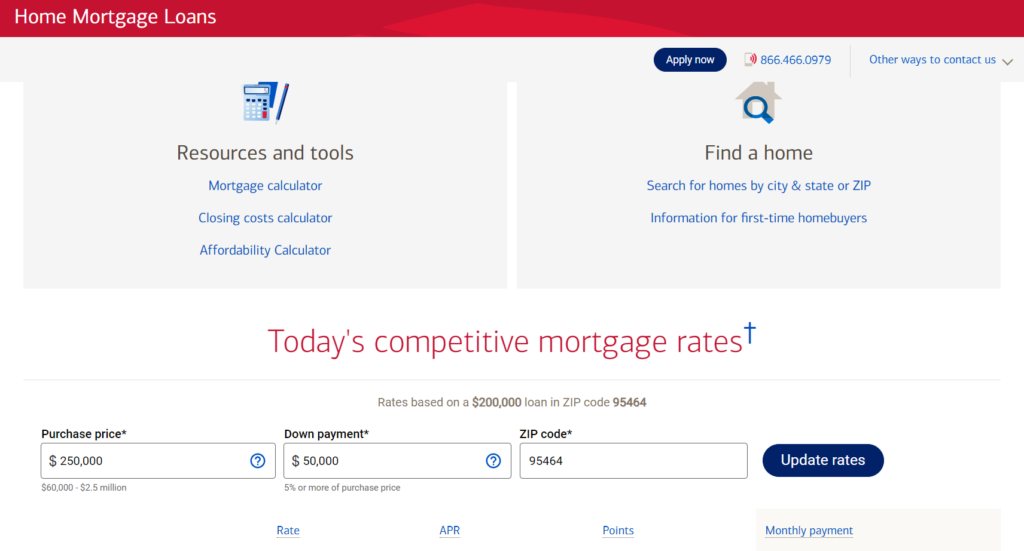

As of August 2, 2024, Bank of America’s mortgage rates for a $200,000 loan in ZIP code 95464 are 6.500% (APR 6.792%) for a 30-year fixed, 6.000% (APR 6.445%) for a 15-year fixed, and 6.500% (APR 7.735%) for a 5/6 ARM. Refinancing rates are slightly higher, with a 30-year fixed refinance at 6.875% (APR 7.053%) and a 15-year fixed refinance at 6.000% (APR 6.295%). These rates assume a borrower with excellent credit (740+ FICO score) and may vary based on factors such as loan amount, property location, and down payment.

For down payment requirements, conventional loans can go as low as 3%, FHA loans require a minimum of 3.5%, VA loans offer 0% down for eligible borrowers, and jumbo loans typically require 10-20%.

WHAT'S THE CATCH WITH BANK OF AMERICA HOME LOANS?

Bank of America’s mortgage offerings come with higher-than-average rates. While its rates are competitive, it often trends slightly higher than the industry average, potentially resulting in thousands of dollars in additional interest over the life of your loan.

Its Preferred Rewards program offers rate discounts and reduced fees for members. However, this requires maintaining significant balances in Bank of America accounts, which may not be feasible or desirable for all borrowers.

Bank of America has a limited product range, with the absence of USDA loans and other specialized mortgage products, which may limit options for some borrowers, particularly those in rural areas or with unique financial situations. As a large financial institution, Bank of America may attempt to sell you additional products or services when you apply for a mortgage. While this can be beneficial if you’re looking to consolidate your banking, it may feel pushy to some customers. Bank of America’s large size can lead to bureaucratic processes and potentially slower response times compared to smaller lenders and likely has stricter underwriting standards than some competitors, which could make it harder for borderline applicants to qualify. It may have less flexibility in terms of underwriting exceptions or customizing loan terms compared to smaller, local lenders.

>>>PRO TIPS: How To Start an S Corp in California

WHAT YOU NEED TO KNOW

Bank of America provides both fixed-rate and adjustable-rate mortgages. Their fixed-rate options include 30-year, 20-year, and 15-year terms, while adjustable-rate mortgages (ARMs) are available in 5/6, 7/6, and 10/6 configurations. In these ARMs, the first number indicates the initial fixed-rate period, and the second number shows how often the rate adjusts afterward (every 6 months).

Bank of America does not disclose all fees upfront, but you should expect to pay for an origination fee, appraisal fee, credit report fee, title insurance, recording fees, and prepaid interest. The exact amounts will vary depending on your location and loan details.

You can pay discount points to lower your interest rate. As of August 2, 2024, their 30-year fixed-rate mortgage had 0.906 points, while the 15-year fixed had 0.748 points.

The Preferred Rewards program offers tiered benefits based on your combined balances in Bank of America banking and Merrill investment accounts. The Gold tier ($20,000-$49,999) provides a $200 reduction in the mortgage origination fee. The Platinum tier ($50,000-$99,999) offers a $400 reduction, and the Platinum Honors tier ($100,000+) provides a $600 reduction. Additionally, Diamond and Diamond Honors tiers offer interest rate reductions, with the Diamond tier ($1,000,000-$9,999,999) providing a 0.25% reduction and the Diamond Honors tier ($10,000,000+) offering a 0.375% reduction.

You can receive a 0.25% interest rate reduction by setting up automatic payments from a Bank of America checking or savings account. For HELOCs, you can get up to a 1.50% interest rate reduction for initial withdrawals ($0.10% per $10,000 withdrawn).

Loan limits include up to $766,550 for conventional loans in most areas and up to $1,149,825 in high-cost areas. FHA loan limits vary by county and are typically lower than conventional limits. VA loans have no set limit, but Bank of America may have internal caps. Jumbo loans can go up to $5 million.

Bank of America offers special programs such as the Affordable Loan Solution mortgage with a 3% down payment on loans up to $766,550, the America’s Home Grant program providing up to $7,500 in closing cost assistance for eligible borrowers, and the Down Payment Grant program offering up to $10,000 or 3% of the purchase price (whichever is less) for down payment assistance in eligible areas.

The Doctor Loan program features special options for medical professionals, including the ability to close 90 days before starting a new job, exclusion of student debt from total debt calculations in some cases, and lower down payment requirements (3% on mortgages up to $850,000, 5% up to $1 million, 10% up to $1.5 million, and 15% up to $2 million).

You can apply for a mortgage through Bank of America online, by phone, in-person at a branch, or through a mortgage loan officer. The online application process typically takes about 15 minutes.

Bank of America offers both prequalification and preapproval options. Closing times at Bank of America are likely similar to industry averages, typically 30-45 days from application to closing.

Bank of America provides customer support via phone, email, and in-person at branches. However, as a large institution, personalized service may be less consistent compared to smaller lenders.

WHAT ARE BANK OF AMERICA'S COMPETITORS OFFERING?

- Wells Fargo: Similar in size and scope to Bank of America, offers a full range of mortgage products, including USDA loans which Bank of America lacks. They provide a yourLoanTracker app for easy application tracking and a unique yourFirst Mortgage program with flexible down payment options. Like Bank of America, Wells Fargo doesn’t disclose minimum credit score requirements.

- NBKC Bank: An online-focused lender, offers competitive rates and no origination fees on VA loans. It accepts a minimum credit score of 620 for most loans and boasts quick closing times, averaging 30 days. This compares favorably to Bank of America, which likely has longer average closing times due to its size and more traditional processes.

- Chase: This is another major bank that offers closing guarantees and rate locks, as well as discounts for existing Chase customers, similar to Bank of America’s Preferred Rewards program. However, Chase’s rates are often slightly higher than some online lenders, putting them in a similar position to Bank of America in terms of pricing.

WHAT AFFECTS BANK OF AMERICA'S PRICES?

They include:

- Housing Market Trends: Supply and demand in the housing market can influence mortgage rates and terms.

- Federal Reserve Policy: Changes in the federal funds rate influence the overall interest rate environment, affecting Bank of America’s mortgage rates.

- Secondary Mortgage Market: Conditions in the secondary market, where mortgages are bought and sold, can impact rates.

- Economic Conditions: Inflation rates, unemployment figures, and overall economic growth impact mortgage rates.

- Customer Relationships: Bank of America’s focus on cross-selling and customer retention affects its mortgage pricing, particularly for existing customers.

WHAT AFFECTS PRICES IN THE INDUSTRY OVERALL?

A few of the industry-wide factors that may affect BOA mortgage prices are:

- Bond Market Performance: Mortgage rates often correlate with 10-year Treasury bond yields.

- Global Economic Conditions: International economic events can impact U.S. mortgage rates.

- Government Policies: Changes in housing policies or tax laws can affect mortgage demand and pricing.

- Technological Advancements: Innovations in mortgage processing and underwriting can impact costs and, consequently, rates.

- Demographic Shifts: Changes in home buying patterns among different age groups can influence mortgage demand and pricing.

- Natural Disasters and Climate Change: These factors can affect property values and insurance costs, indirectly impacting mortgage terms.

- Investor Appetite: Demand for mortgage-backed securities in the secondary market can influence primary market rates.

- Credit Availability: Overall trends in credit availability and lending standards can impact mortgage pricing across the industry.

>>>GET SMARTER: How To Start a Sole Proprietorship in Rhode Island

HOW TO GET THE BEST DEAL WITH BANK OF AMERICA?

- Improve your credit score

- Save for a larger down payment

- Join the Preferred Rewards program

- Compare loan options

- Consider paying points

- Negotiate fees

- Bundle services

- Use grant programs

- Apply with a co-borrower

- Consider an ARM for short-term ownership

CAN YOU AFFORD BANK OF AMERICA'S PRICES?

What is your debt-to-income ratio, and how does it impact your mortgage eligibility? How does your housing expense ratio compare to your overall budget? What is the amount of your down payment, and how does it affect your monthly payment? How will your total loan cost influence your long-term financial goals? Are there additional costs you need to account for, and how might they impact your overall budget?

How stable is your future income, and what does it mean for your ability to make mortgage payments? What is the potential for appreciation in your desired area, and how does it affect your investment? Have you considered the rent vs. buy comparison in relation to your financial situation? Finally, how does this mortgage fit into your total wealth picture and long-term financial strategy?

Determining whether you can afford a Bank of America mortgage involves these considerations.

FINALLY: SHOULD YOU BUY A BANK OF AMERICA HOME LOAN OR NOT?

After careful consideration of Bank of America’s home loan offerings, pricing structure, customer service, and industry position, do not choose Bank of America home loan(s).

Although Bank of America is a well-regarded institution with a broad range of products and a strong national presence, its mortgage offerings have some notable drawbacks.

First, you’ll find that Bank of America’s interest rates are generally higher than the industry average. In a long-term financial commitment like a mortgage, even a slight increase in interest rates can lead to significant additional costs over the life of the loan.

Second, you should be aware that the bank’s large size and rigid structure often result in a less personalized experience. Consider smaller lenders or online mortgage specialists who might offer the personalized service and potentially faster processing times that many homebuyers need.

Additionally, Bank of America’s product range is more limited compared to some competitors. The absence of specialized mortgage products, such as USDA loans, could mean that some borrowers find fewer suitable options. This limited variety in loan products indicates that Bank of America may not meet the diverse needs of all homebuyers.

While Bank of America offers some attractive features, like the Preferred Rewards program and the Doctor Loan program, these benefits are specific to certain customer segments. For the average borrower, these perks might not outweigh the drawbacks of higher rates and less flexible service.

Ultimately, in today’s competitive mortgage market, you’ll likely find better options by shopping around. Remember, a mortgage is likely the largest financial commitment you’ll make. While Bank of America is a stable institution, its mortgage offerings may not offer the best rates, flexibility, or unique benefits for you.

So, unless you’re already deeply involved with Bank of America and stand to benefit significantly from its Preferred Rewards program, or if you’re a medical professional who could take advantage of its specialized programs, you should explore other options for your home loan needs.

No Comment! Be the first one.