Our Verdict

Consider Fifth Third Bank if you need personal banking services, business banking, commercial banking, or wealth management services. With branches in 11 states, including Ohio, Florida, Illinois, Michigan, and North Carolina, the bank offers a range of financial services to meet your needs.

To apply for a personal loan or any other service offered by Fifth Third Bank, you can visit the bank’s website at www.53.com or call the bank’s customer service number at 1-800-972-3030. Additionally, you can visit a Fifth Third Bank branch in person to speak with a banker and apply for a loan or other service.

Pros

- Provides access to over 50,000 ATMs across the United States

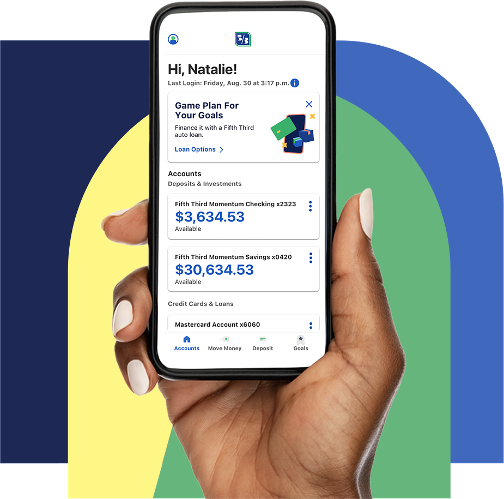

- Offers mobile banking

- Provides online and in-banking options

- No origination fee or prepayment penalties

- Wide range of financial services

Cons

- Limited branch locations

- Higher fees

- Reports of poor customer service

- Uncompetitive interest rates on savings accounts and CDs

- Difficulties with online banking and mobile app

Who This Product Is Best For

Think of Fifth Third Bank personal loans if you:

- Prefer to work with a bank with a large network of branches and ATMs

- Have an account with Fifth Third Bank

- Want a loan with flexible repayment terms

- Have an excellent credit scores

- Need financing for home improvements or repairs

Who This Product Isn't Right For

Don’t think of Fifth Third if you need a personal loan but:

- Prefer a lender with more transparent fee structures

- Don’t have a Fifth Third Bank branch nearby

- Want a loan with quick turnaround time

- Prefer a completely online loan application process

- Need a loan with a high borrowing limit

What This Product Offers

Signature Loans: Need funds for a big expense, but don’t want to put up collateral? Consider signature loans from Fifth Third Bank. Just make sure you have a strong credit score to qualify!

Secured Personal Loans: If you have collateral to put up, a secured personal loan may be a better option for you. Fifth Third Bank offers loans that are secured by a savings account, certificate of deposit, or vehicle.

Product Details

Signature Loans: If you’re looking for a lump sum of cash to cover a large expense, but don’t want to put up collateral to secure the loan, Fifth Third Bank’s signature loans may be a great option for you. These loans offer flexibility and can be used for a variety of purposes, such as home repairs, medical bills, or debt consolidation.

However, it’s important to note that to qualify for a signature loan from Fifth Third Bank, you’ll need to have a strong credit score. Additionally, you should carefully review the interest rate, terms, and fees associated with the loan to ensure it fits your financial needs and goals.

With that said, if you do have a strong credit score and are in need of funds for a large expense, a signature loan from Fifth Third Bank may be the solution you’re looking for. Consider speaking with a banker or visiting the bank’s website to learn more and apply.

Loan Amounts | $2,000 to $50,000 |

Repayment Terms | 12-60 months |

APR | 8.24% – 21.24% |

Prepayment Fee | No prepayment fee |

Secured Personal Loans: Fifth Third Bank offers secured personal loans that require collateral such as a savings account, certificate of deposit, or vehicle. Consider applying for a secured personal loan if you have collateral to put up, and make sure to compare the loan amounts, APR, and terms to find the best fit for your needs. Don’t forget to review any fees associated with the loan before making a final decision.

Loan Amounts | $2,000 to $500,000 |

Repayment Terms | 12-60 months |

APR | 5.14% – 8.64% |

Prepayment Fee | No prepayment fee |

Where This Product Stands Out

Wide range of loan options to choose from

Looking for a personal loan that meets your specific needs? Fifth Third Bank offers a wide range of loan options to choose from. Whether you’re looking for an unsecured loan or a secured loan that’s backed by collateral, you’ll find options that fit your unique situation. Explore Fifth Third Bank’s loan offerings today and find the perfect loan for you!

No prepayment penalties

Take control of your loan repayment by choosing Fifth Third Bank! When you pay off your personal loan early, you won’t be hit with any prepayment penalties. This means you can save money on interest and pay off your loan faster without any additional fees.

Competitive interest rates

Want to secure a personal loan with competitive interest rates? Fifth Third Bank has got you covered! With a personal loan from Fifth Third, you can enjoy the benefits of competitive interest rates that will save you money in the long run. Make sure to compare rates from other lenders to see how Fifth Third’s rates measure up.

Access to financial education resources

Take advantage of Fifth Third Bank’s financial education resources! With your personal loan, you can access a wide range of tools and resources to help you make informed decisions about your finances. From online courses to in-person workshops, there are plenty of options to help you learn and grow your financial knowledge. Start exploring today!

Where This Product Falls Short

Higher credit score requirements

Keep in mind that some loans may require a higher credit score. Make sure to check the requirements before applying to ensure that you meet the criteria. Consider taking steps to improve your credit score if needed to increase your chances of approval.

Limited availability in certain areas

If you’re considering Fifth Third Bank for a personal loan, be aware that availability may be limited in certain areas. Make sure to check if the bank operates in your area before applying for a loan.

Additional fees and charges may apply

When considering Fifth Third Bank’s personal loan options, keep in mind that additional fees and charges may apply. Be sure to read the terms and conditions carefully and ask questions to fully understand any fees associated with your loan.

How to Qualify for This Product

- Meet the minimum credit score requirements for the specific loan you are applying for.

- Have a steady source of income and a low debt-to-income ratio.

- Be at least 18 years old and a U.S. citizen or permanent resident.

- Provide personal identification, such as a driver’s license or passport.

- Have a valid Social Security number.

How to Apply for This Product

While a Fifth Third representative did not give details regarding its application requirements, they mentioned that the necessary documents may vary depending on your circumstances, and that a Fifth Third banker can guide you through the application process. Nonetheless, it’s common to need to provide these documents for most personal loan applications, in addition to any other lender-specific requirements.

To apply for a personal loan with Fifth Third Bank, you can follow these simple steps:

- Visit Fifth Third Bank’s website or go to a local branch to begin the application process.

- Gather all necessary documentation, such as your ID, proof of income, and any other requested financial information.

- Fill out the online application or meet with a loan officer at the bank to complete the application process.

- Await a decision from Fifth Third Bank regarding your loan application.

- If approved, review and accept the loan terms, including the interest rate and repayment schedule.

Alternatives to This Product

Discover: Discover offers personal loans from $2,500 to $35,000 with APRs ranging from 6.99% to 24.99%. A minimum credit score of 660 is required, and they operate in all 50 states.

SoFi: SoFi offers personal loans ranging from $5,000 to $100,000 with APRs ranging from 5.99% to 19.63%. A minimum credit score of 680 is required, and they operate in 49 states.

Avant: Avant offers personal loans ranging from $2,000 to $35,000 with APRs ranging from 9.95% to 35.99%. A minimum credit score of 580 is required, and they operate in all states except Colorado, Iowa, Vermont, and West Virginia.

Customer Reviews

According to 84 customer reviews on Trustpilot, Fifth Third Bank has an average rating of only 1.4 out of 5 stars. The reviews highlight various issues such as poor customer service, unanticipated fees, and fraudulent activity, indicating a general dissatisfaction among customers. Although there are some positive reviews, the majority of feedback suggests that Fifth Third Bank needs to enhance its transparency and customer service.

Methodology

We reviewed *this product* based on 20 data points in the categories of loan details, loan costs, eligibility and accessibility, customer experience and the application process. We rated *this product* based on the weighting assigned to each category:

- Loan cost: 35%

- Loan details: 25%

- Customer experience: 20%

- Eligibility and accessibility: 10%

- Application process: 10%

Within each major category, we also considered several characteristics, including available loan amounts, repayment terms and applicable fees. We also looked at minimum credit score and time in business requirements and the geographic availability of the lender. Finally, we evaluated *this product* customer support tools, borrower perks and features that simplify the borrowing process—like online applications, prequalification options and mobile apps.

No Comment! Be the first one.