Introduction

Starting an S Corporation in Rhode Island offers many advantages for your business. This structure provides liability protection, allowing you to separate personal assets from business debts. You gain tax benefits as well, including the avoidance of double taxation. Choosing this entity type gives you flexibility in managing your business while meeting state regulations.

Rhode Island encourages entrepreneurship and supports small businesses, making it an ideal location for your S Corp. You navigate a friendly business environment with resources available to help you succeed. Understanding the unique benefits of an S Corporation empowers you to make informed decisions for your business’s future.

1. Choose a Name for Your S Corp

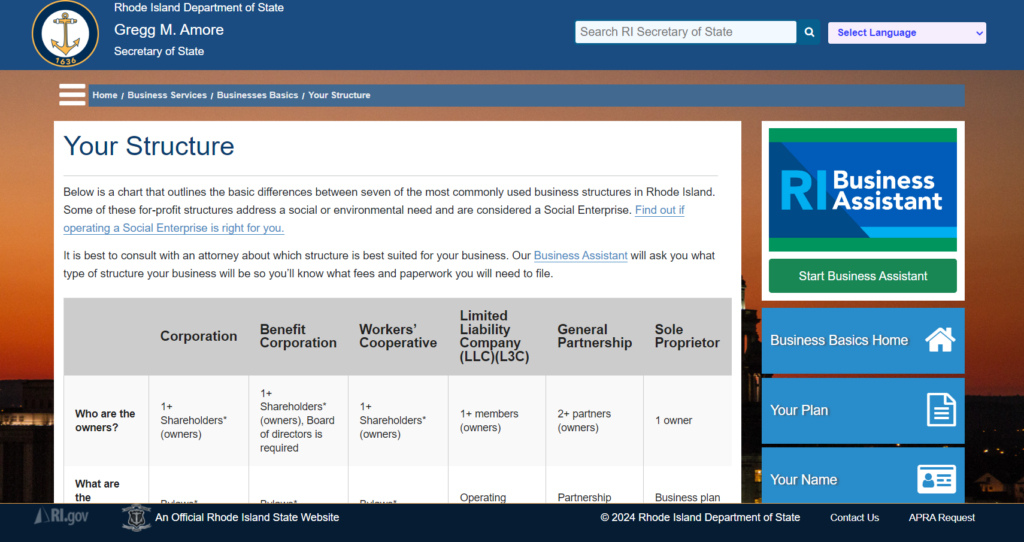

Choosing a name for your S Corporation in Rhode Island is essential. Ensure the name reflects your business and captures attention. Check the name’s availability by searching the Rhode Island Secretary of State’s database. The name must be unique and not resemble any existing businesses in the state. Include “Corporation” or abbreviations like “Corp.” or “Inc.” to meet state requirements.

Avoid names that might confuse your business with government entities. If you want a web presence, secure a matching domain name for consistency. Remember to register your chosen name officially once you finalize it. Following these guidelines sets a solid foundation for your S Corp, creating a recognizable identity for potential customers.

2. Appoint Directors and Officers

Appoint directors and officers for your S Corporation in Rhode Island. Ensure you understand the roles and responsibilities these individuals will assume. Choose at least one director who will manage the corporation’s affairs. Appoint officers such as a president, treasurer, and secretary, who handle day-to-day operations. Make decisions about the qualifications for these positions and outline the terms of service.

You must document these appointments in the corporate records and maintain an official record of each decision. This record proves vital for compliance and corporate governance. Review the Rhode Island General Laws for specific requirements regarding the appointment process. Follow these guidelines to establish a strong foundation for your S Corporation.

3. File Articles of Incorporation

File Articles of Incorporation to establish your S Corporation in Rhode Island. Visit the Rhode Island Secretary of State’s website to obtain the necessary forms. Ensure you provide essential information, including your business name, registered agent details, and the purpose of your corporation. You must also include the number of authorized shares.

Submit your completed form along with the filing fee, which currently amounts to $230 for standard processing. Consider expedited services if you need faster processing. Once filed, the state reviews your application and issues a Certificate of Incorporation upon approval. Keep a copy of the articles for your records. This document serves as a foundational requirement for your S Corporation.

>>>PRO TIPS: How to Start an LLC in Michigan

4. Designate a Registered Agent

Designate a registered agent as a crucial step when forming your S Corporation in Rhode Island. You need a registered agent to receive legal documents and important notices on behalf of your business. Select a reliable individual or a professional service that has a physical address in Rhode Island. Ensure that the registered agent is available during regular business hours, as this helps maintain compliance with state requirements.

You benefit from appointing someone who understands your industry and can manage communications effectively. File the registered agent’s information with the Rhode Island Secretary of State during your formation process. Keep this information updated to avoid penalties and ensure smooth operations for your S Corporation.

5. Create Corporate Bylaws

Create corporate bylaws when starting an S Corporation in Rhode Island. Bylaws outline your corporation’s governance structure and procedures. Ensure your bylaws include essential elements such as the organization’s name, purpose, and registered agent information. Establish rules for board meetings, including frequency and notification requirements. Set forth voting procedures and define the roles of officers and directors.

Specify how to handle conflicts of interest and amendments to the bylaws. Consider including provisions for shareholder meetings and decision-making processes. Draft your bylaws carefully, as these bylaws serve as a vital internal document that guides your corporation’s operations.

6. Hold an Organizational Meeting

Hold an organizational meeting to lay the groundwork for your S Corporation in Rhode Island. Record minutes of the meeting to document decisions and actions taken. This documentation is essential for maintaining transparency and legal protection. Secure any necessary permits and licenses relevant to your business. This meeting sets the stage for future success.

7. Obtain an Employer Identification Number (EIN)

The next step is to obtain an Employer Identification Number (EIN) in starting your S Corporation in Rhode Island. Visit the IRS website to access the online application for an EIN. Fill out the application accurately, ensuring you provide all required information about your business. You receive your EIN immediately upon completion, which serves as your business’s unique identifier for tax purposes.

Use your EIN when opening a business bank account, applying for licenses, and filing taxes. Keep your EIN secure and store it with important business documents. This number simplifies your business’s tax reporting and helps establish credibility with clients and vendors. Prioritize obtaining your EIN to facilitate your S Corp’s operations smoothly.

8. File for S Corporation Status

To file for S Corporation status in Rhode Island, gather essential documents like your articles of incorporation and Employer Identification Number (EIN). Complete IRS Form 2553, which is necessary to elect S Corp status. Ensure you meet the eligibility criteria, such as having 100 or fewer shareholders and only one class of stock.

Submit Form 2553 to the IRS, ensuring you do so within 75 days of your incorporation. After approval, file any necessary state forms with the Rhode Island Division of Taxation to comply with local regulations. Keep a copy of your election for your records.

9. Comply with Rhode Island Tax and Regulatory Requirements

Ensure full compliance with Rhode Island tax and regulatory requirements to move forward with your S Corporation. Start by obtaining a Rhode Island business license tailored to your business’s needs, as these licenses are mandatory for legally operating in the state. If applicable, secure additional permits specific to your industry.

Register for a Rhode Island sales tax permit if your business involves selling goods or services. Don’t forget to file your business’s tax registration with the Rhode Island Division of Taxation. Finally, check for any additional employer requirements, like unemployment insurance and workers’ compensation coverage, to maintain full legal compliance.

10. Maintain Compliance and Corporate Records

To maintain compliance and corporate records in Rhode Island, ensure you follow state regulations closely. Regularly update corporate bylaws, meeting minutes, and shareholder agreements. File annual reports with the Rhode Island Secretary of State to stay compliant.

Track your business’s financial activities, including payroll and distributions, for tax purposes. Following these steps ensures your S Corp remains in good standing and continues to benefit from its legal protections and tax advantages.

Recap

To start an S Corp in Rhode Island, first choose a unique business name that follows state guidelines. Appoint a registered agent with a physical address in Rhode Island. File the Articles of Incorporation with the Secretary. Next, create an operating agreement to outline management responsibilities. Obtain an Employer Identification Number (EIN). Finally, elect S Corp status by filing an IRS Form. Ensure all shareholders agree to S Corp taxation.

No Comment! Be the first one.